Financial Impact: Car Stolen No Insurance

Car stolen no insurance – Losing a car without insurance can be a financially devastating experience. Not only do you lose your primary mode of transportation, but you also face a significant financial burden to replace the vehicle and cover associated costs.The financial implications of a stolen car without insurance are substantial and can significantly impact your financial stability.

Here’s a breakdown of the potential costs involved:

Vehicle Replacement Costs

Replacing a stolen car without insurance can be a major financial blow. The cost of purchasing a new or used car can range widely depending on the make, model, year, and condition of the vehicle. For example, replacing a late-model luxury car can cost tens of thousands of dollars, while a used compact car might cost a few thousand.

Towing Costs

If your car is recovered, you’ll likely face towing charges. Towing costs can vary depending on the distance, type of tow truck, and time of day. In some cases, you may also be responsible for storage fees if your car is impounded.

Administrative Fees

Filing a police report and dealing with insurance claims can involve administrative fees. These fees can include charges for filing the police report, obtaining a copy of the report, and processing the insurance claim.

Financial Burden on the Car Owner

The financial burden of a stolen car without insurance can be significant. In addition to the direct costs mentioned above, you may also face lost wages if you’re unable to get to work, increased transportation expenses, and potential damage to your credit score if you’re unable to make payments on your car loan.

Legal and Reporting Procedures

Losing a car to theft is a stressful and confusing experience. It’s crucial to take immediate action to report the theft to the authorities and your insurance company. This section Artikels the legal steps involved in reporting a stolen car, along with the necessary documentation and procedures.

Filing a Police Report, Car stolen no insurance

It is crucial to file a police report as soon as you realize your car has been stolen. This report is the primary documentation for insurance claims and any legal actions you may need to take.

- Contact your local police departmentimmediately. Provide them with as much information as possible about the theft, including the time and location of the theft, the vehicle’s make, model, year, color, license plate number, and any unique identifying features.

- Be prepared to provide detailed informationabout the car’s contents, including any valuables, electronics, or other items that were inside. This helps the police in their investigation and also assists with insurance claims.

- Obtain a copy of the police report. This report will be essential for filing an insurance claim and any subsequent legal proceedings.

Contacting Your Insurance Company

Once you’ve filed a police report, contact your insurance company to report the stolen car. They will guide you through the necessary steps for filing a claim.

- Inform your insurance companyof the theft and provide them with the police report number.

- Provide your insurance policy detailsand any other relevant information requested by the insurance company.

- Be prepared to answer questionsabout the theft and your vehicle. This will help them process your claim efficiently.

- Follow the instructions provided by your insurance companyfor submitting the necessary documentation and completing the claim process.

Documentation Required for Reporting Theft

To report a stolen car, you will need to provide specific documentation to both the police and your insurance company.

- Vehicle registration: This document proves your ownership of the car.

- Vehicle title: This document shows the legal ownership of the vehicle.

- Proof of insurance: This document demonstrates that you had insurance coverage at the time of the theft.

- Police report: This document provides official documentation of the theft.

- Any other relevant documentation: This could include photos of the car, repair receipts, or any other documents that can support your claim.

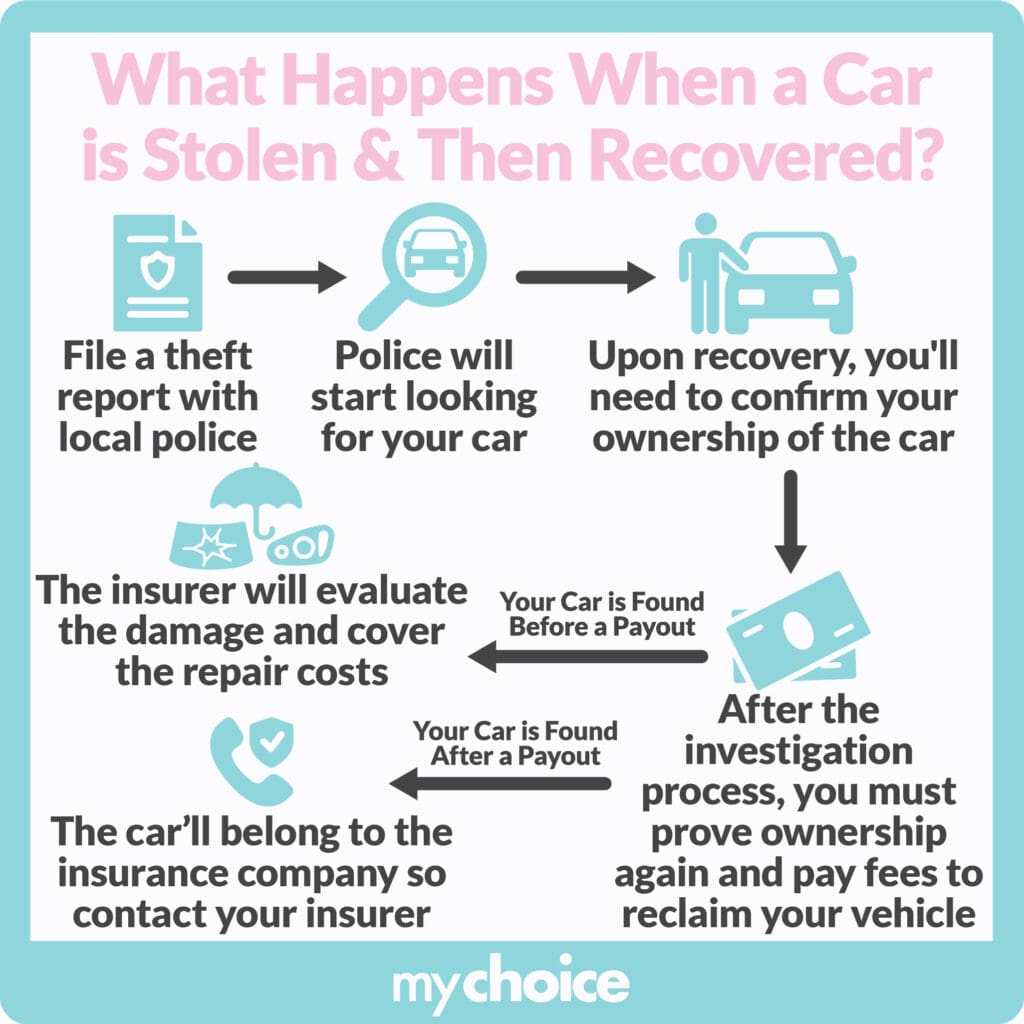

Recovery and Investigation

The process of recovering a stolen car is multifaceted and often involves collaboration between the vehicle owner, law enforcement agencies, and potentially private investigators. The likelihood of recovering a stolen car depends on various factors, including the vehicle’s make and model, the time elapsed since the theft, and the actions taken by authorities.

Law Enforcement’s Role in Investigating Stolen Cars

Law enforcement agencies play a crucial role in investigating stolen cars. The process typically involves:

- Filing a Police Report:The first step is to file a police report, providing detailed information about the vehicle, the circumstances of the theft, and any potential leads. This report serves as the foundation for the investigation.

- Collecting Evidence:Investigators will gather evidence at the scene of the theft, including any fingerprints, tire tracks, or surveillance footage. They may also interview witnesses and gather information from the vehicle’s owner.

- Tracing the Vehicle:Law enforcement uses various techniques to trace the stolen vehicle, including GPS tracking, license plate recognition systems, and collaboration with neighboring jurisdictions.

- Identifying Suspects:Through investigations, authorities may identify suspects based on evidence, witness accounts, or known criminal activities.

Potential for Recovering a Stolen Vehicle

The chances of recovering a stolen car vary depending on several factors, including:

- Vehicle Type:High-end or luxury vehicles are more likely to be targeted for theft, but they are also more likely to be recovered due to increased law enforcement attention and the use of sophisticated tracking systems.

- Time Elapsed:The sooner a car is reported stolen, the higher the likelihood of recovery. As time passes, the stolen vehicle may be moved, disassembled, or exported, making recovery more challenging.

- Law Enforcement Efforts:The effectiveness of law enforcement agencies in investigating and recovering stolen cars varies geographically. Areas with dedicated auto theft units and advanced technologies have higher recovery rates.

- Vehicle Tracking Devices:Cars equipped with GPS tracking devices or other anti-theft technologies offer a significant advantage in recovery. These devices can provide real-time location data, enabling authorities to locate and recover the stolen vehicle.

Working with Authorities During the Investigation

Cooperation with law enforcement is crucial for maximizing the chances of recovering a stolen car. Here’s how you can contribute:

- Provide Complete Information:Be prepared to provide detailed information about the vehicle, including its make, model, year, VIN, color, license plate number, and any distinguishing features. Include details about the circumstances of the theft, such as the time and location, and any potential witnesses or suspects.

- Maintain Communication:Stay in touch with the investigating officer, providing any updates or new information that may be relevant to the case. Be responsive to requests for additional details or documentation.

- Be Patient:Investigating a stolen car can take time. Be patient and understand that law enforcement officers are working diligently to recover your vehicle.

- Consider Private Investigators:In some cases, hiring a private investigator can supplement law enforcement efforts, especially if the theft involves complex circumstances or if the case is not progressing as quickly as desired.

Emotional Impact

Beyond the financial and logistical challenges, car theft carries a significant emotional burden. The experience can leave victims feeling violated, frustrated, and vulnerable.

Coping With Emotional Impact

The emotional impact of car theft can be overwhelming. Here are some tips to help you cope:

- Acknowledge and validate your feelings. It’s natural to feel a range of emotions, including anger, sadness, frustration, and fear. Allow yourself to experience these emotions without judgment.

- Talk to someone you trust. Sharing your experience with a friend, family member, or therapist can help you process your emotions and feel supported.

- Practice self-care. Engaging in activities that bring you joy and relaxation, such as exercise, spending time in nature, or listening to music, can help reduce stress and improve your mood.

- Focus on what you can control. While you can’t change the fact that your car was stolen, you can focus on taking steps to recover and move forward.

- Seek professional help if needed. If you are struggling to cope with the emotional impact of car theft, consider seeking professional counseling or therapy.

Prevention Strategies

Preventing car theft requires a proactive approach, encompassing both vehicle security measures and responsible parking habits. Implementing these strategies can significantly reduce the risk of your car becoming a target for thieves.

Vehicle Security Measures

Vehicle security measures play a crucial role in deterring car thieves. Implementing these measures can significantly reduce the likelihood of your car being stolen.

- Alarm Systems:Modern car alarms can effectively deter thieves by triggering a loud siren and notifying you or the authorities in case of unauthorized entry. Choose alarms with advanced features, such as motion sensors and remote start capabilities, for enhanced protection.

- Steering Wheel Locks:Steering wheel locks physically prevent the steering wheel from turning, making it difficult for thieves to drive the car away. These devices are inexpensive and readily available.

- Immobilizers:Immobilizers are electronic devices that prevent the car from starting without a valid key. They work by disabling the engine’s ignition system, effectively rendering the car inoperable.

- GPS Tracking Devices:GPS tracking devices allow you to monitor your car’s location in real-time. If your car is stolen, the tracking device can help you recover it quickly.

- Car Security Systems:Installing a comprehensive car security system, which may include features like remote keyless entry, alarm systems, and GPS tracking, can significantly enhance your car’s protection against theft.

Safe Parking Practices

Choosing safe parking locations and taking necessary precautions can further reduce the risk of car theft.

- Well-Lit Areas:Park your car in well-lit areas, as thieves are less likely to target vehicles that are visible.

- High-Traffic Areas:Parking in high-traffic areas, such as busy parking lots or streets with surveillance cameras, can deter thieves.

- Secured Parking Garages:Utilize secured parking garages whenever possible, as they offer a higher level of protection.

- Avoid Parking in Isolated Areas:Avoid parking your car in isolated areas, such as deserted streets or dimly lit parking lots, as these locations make it easier for thieves to operate undetected.

- Valuables:Never leave valuables in plain sight within your car, as this can attract thieves. Store them in the trunk or take them with you.

Insurance Options and Considerations

When a car is stolen without insurance coverage, the financial burden of replacement or repair falls entirely on the owner. Understanding car insurance options and their coverage is crucial to mitigating such risks.

Types of Car Insurance and Their Coverage

Car insurance policies are categorized based on the type of coverage they provide.

- Liability Coverage:This is the most basic type of insurance and is mandatory in most states. It covers damages caused to other people or their property in an accident for which you are at fault. Liability coverage includes bodily injury liability and property damage liability.

- Collision Coverage:This coverage pays for repairs or replacement of your car if it is damaged in an accident, regardless of fault. It applies even if you hit a stationary object. Collision coverage typically has a deductible, which is the amount you pay out-of-pocket before the insurance company covers the rest.

- Comprehensive Coverage:This coverage protects your car against damages caused by events other than accidents, such as theft, vandalism, natural disasters, or falling objects. Like collision coverage, it often has a deductible.

- Uninsured/Underinsured Motorist Coverage:This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. It covers medical expenses and property damage for you and your passengers.

- Personal Injury Protection (PIP):This coverage pays for your medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of fault. It is available in some states.

Benefits and Drawbacks of Comprehensive and Collision Coverage

Comprehensive Coverage

- Benefits:Provides protection against a wide range of risks, including theft, vandalism, and natural disasters. This can be particularly valuable in areas prone to such events.

- Drawbacks:The premium for comprehensive coverage can be relatively high, especially for newer or more expensive vehicles. It may not be necessary for older cars with lower market value.

Collision Coverage

- Benefits:Provides financial protection for repairs or replacement of your car in the event of an accident. It is essential for newer vehicles and those with significant market value.

- Drawbacks:The premium for collision coverage can be high, especially for high-performance or expensive cars. It may not be necessary for older cars with lower market value.

Insurance Premiums and Coverage Options

Insurance premiums are determined by several factors, including the type of coverage, the vehicle’s value, the driver’s age and driving record, and the location of the vehicle. You can adjust your coverage options and deductibles to lower your premium, but this can also reduce the amount of financial protection you receive.

Example:A driver with a clean driving record and a 2010 Toyota Camry may pay a lower premium for comprehensive and collision coverage compared to a driver with a history of accidents and a 2023 Tesla Model S.

Question Bank

What should I do if my car is stolen and I don’t have insurance?

Immediately report the theft to the police and obtain a police report. Contact your local DMV to report the stolen vehicle and update your registration. Explore options for replacing your vehicle, such as seeking financial assistance from family or friends, or considering a loan.

Consult with a legal professional to understand your rights and options.

Can I file a claim with my insurance company if I have comprehensive coverage but no collision coverage?

Yes, comprehensive coverage typically covers theft, regardless of whether collision coverage is included. However, the payout may be subject to a deductible and other policy limitations.

How long does it take for the police to recover a stolen car?

The time it takes to recover a stolen car varies greatly depending on factors such as the vehicle’s make and model, the location of the theft, and the effectiveness of law enforcement efforts. Some stolen cars are recovered quickly, while others may never be found.