Florida Motorcycle Insurance Requirements

Motorcycle insurance required in florida – Riding a motorcycle in Florida is a popular pastime, but it’s important to understand the state’s motorcycle insurance requirements to ensure you’re protected on the road. This guide provides a comprehensive overview of Florida’s motorcycle insurance regulations, including the mandatory coverages and minimum coverage amounts.

Mandatory Coverages

Florida law requires all motorcycle owners to carry certain types of insurance coverage. These coverages are designed to protect you and others in case of an accident.

- Liability Coverage:This coverage protects you financially if you cause an accident that results in injury or damage to another person or their property. It covers the costs of medical bills, lost wages, and property repairs.

- Property Damage Liability Coverage:This coverage protects you financially if you cause damage to another person’s property, such as their car or home. It covers the costs of repairs or replacement of the damaged property.

- Personal Injury Protection (PIP):This coverage helps pay for your medical expenses and lost wages if you’re injured in an accident, regardless of who was at fault. It’s also known as “no-fault” insurance.

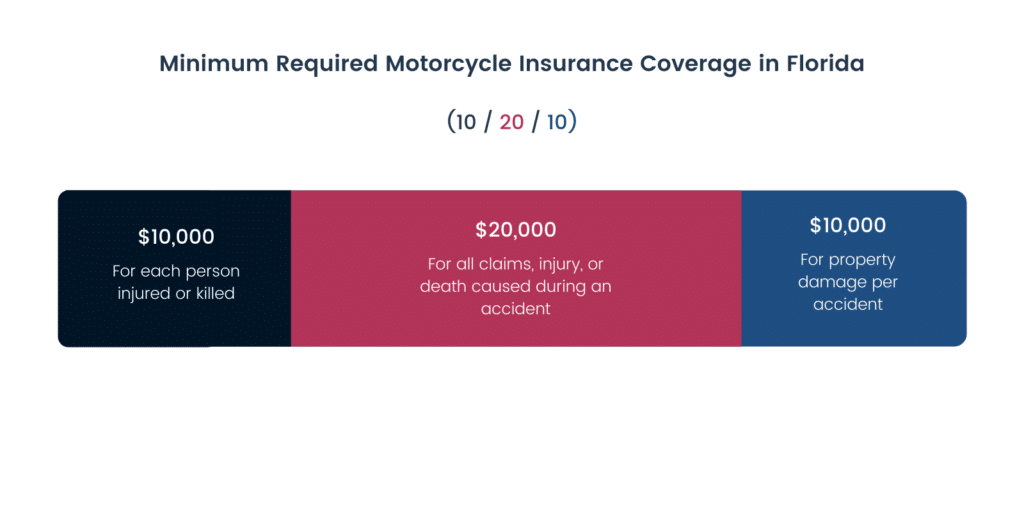

Minimum Coverage Amounts

Florida law mandates specific minimum coverage amounts for motorcycle insurance. These amounts are the minimum you’re required to carry to be legally compliant.

- Liability Coverage:

$10,000 per person/$20,000 per accident for bodily injury.

$10,000 per accident for property damage.

- Personal Injury Protection (PIP):

$10,000 per person.

Types of Motorcycle Insurance Policies

In Florida, motorcycle insurance policies come in various forms, each offering different levels of coverage and protection. Understanding these policy types is crucial to choosing the right coverage for your needs and budget.

Comprehensive Coverage

Comprehensive coverage protects your motorcycle against damage or loss caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. This coverage is optional, but it can be essential for protecting your investment, especially if you own a high-value motorcycle.

Collision Coverage

Collision coverage pays for repairs or replacement of your motorcycle if it’s damaged in an accident, regardless of who is at fault. This coverage is also optional, but it can be crucial if you’re concerned about the financial burden of repairs or replacement in the event of an accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient insurance to cover your damages. This coverage is required in Florida and can be crucial for protecting yourself financially if you’re injured in an accident with an uninsured driver.

Medical Payments Coverage

Medical payments coverage (MedPay) pays for your medical expenses, regardless of fault, if you’re injured in a motorcycle accident. This coverage is optional, but it can be valuable for covering out-of-pocket medical expenses that may not be covered by your health insurance.

Factors Affecting Motorcycle Insurance Rates: Motorcycle Insurance Required In Florida

The cost of motorcycle insurance in Florida can vary significantly based on a range of factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money on your premiums. The following sections explore some of the most influential factors that insurance companies consider when determining your motorcycle insurance rates.

Rider Age and Experience

Insurance companies generally view younger and less experienced riders as higher risk. This is because they are statistically more likely to be involved in accidents. As you gain experience and age, your premiums may decrease.

Credit Score, Motorcycle insurance required in florida

Your credit score can surprisingly impact your motorcycle insurance rates. Insurance companies believe that those with good credit are more responsible and likely to make timely payments, which translates to lower premiums.

Motorcycle Type

The type of motorcycle you own significantly affects your insurance rates. High-performance motorcycles, like sportbikes, are often considered riskier to insure due to their higher speeds and potential for accidents. Conversely, motorcycles with lower engine capacities and more conservative designs typically have lower insurance rates.

Driving History

Your driving history plays a crucial role in determining your motorcycle insurance rates. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher rates.

Table Comparing Average Insurance Rates

| Rider Profile | Motorcycle Type | Average Annual Premium |

|---|---|---|

| 25-year-old with clean driving record | Cruiser (Harley Davidson) | $1,200 |

| 25-year-old with clean driving record | Sportbike (Yamaha R1) | $1,500 |

| 35-year-old with 5 years of experience and clean record | Cruiser (Harley Davidson) | $1,000 |

| 35-year-old with 5 years of experience and clean record | Sportbike (Yamaha R1) | $1,200 |

| 45-year-old with 10 years of experience and clean record | Cruiser (Harley Davidson) | $800 |

| 45-year-old with 10 years of experience and clean record | Sportbike (Yamaha R1) | $1,000 |

Note:These rates are estimates and can vary depending on the specific insurance company, coverage levels, and other factors.

FAQ Explained

What are the minimum liability insurance requirements in Florida?

Florida law requires a minimum of $10,000 in property damage liability and $10,000 per person/$20,000 per accident for bodily injury liability.

Can I get a discount on my motorcycle insurance if I take a motorcycle safety course?

Yes, many insurance companies offer discounts to riders who complete a motorcycle safety course approved by the Florida Department of Highway Safety and Motor Vehicles.

What is the difference between comprehensive and collision coverage?

Comprehensive coverage protects your motorcycle against damage from events other than collisions, such as theft, vandalism, or natural disasters. Collision coverage pays for repairs or replacement if your motorcycle is involved in an accident, regardless of who is at fault.

How do I file a motorcycle insurance claim in Florida?

After an accident, immediately report the incident to your insurance company, gather evidence such as police reports and witness statements, and follow the instructions provided by your insurer.