What is Nissan Gap Insurance?

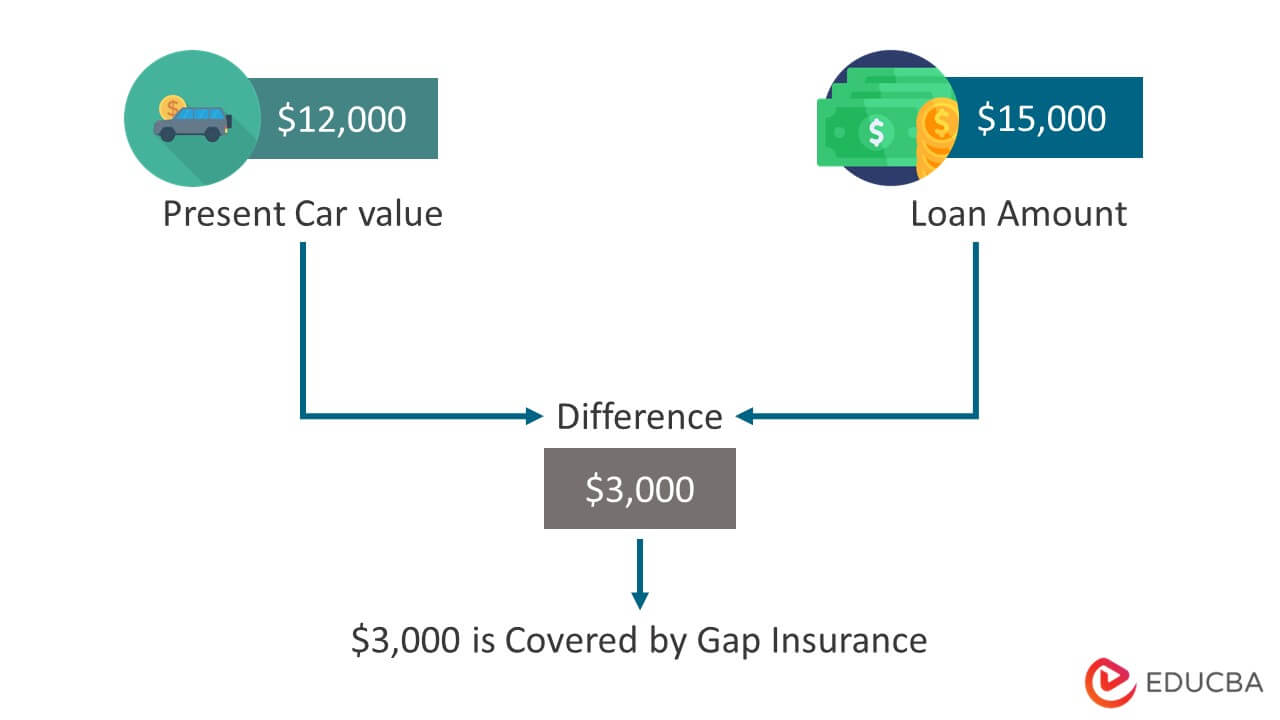

Nissan gap insurance coverage – Nissan Gap Insurance is a type of insurance that helps cover the difference between what you owe on your car loan and what your insurance company pays out in the event of a total loss. This means that if your car is totaled in an accident, your insurance company may not cover the entire amount of your loan, leaving you with a significant amount of debt.

Nissan Gap Insurance helps to bridge that gap, ensuring that you are not left with a financial burden.

Benefits of Nissan Gap Insurance

Nissan Gap Insurance is beneficial in various situations, especially when your vehicle’s value depreciates faster than your loan balance. This is common with new cars, as they lose value quickly in the first few years.

Scenarios Where Nissan Gap Insurance Would Cover Losses

Here are some scenarios where Nissan Gap Insurance would cover losses:

- Total Loss:If your car is totaled in an accident, your insurance company will pay out the actual cash value (ACV) of your car. This is typically less than the amount you owe on your loan, especially if the car is relatively new.

Nissan Gap Insurance would cover the difference between the ACV and your loan balance, ensuring you are not left with debt.

- Theft:If your car is stolen and not recovered, your insurance company will pay out the ACV. Similar to a total loss, Nissan Gap Insurance would cover the difference between the ACV and your loan balance.

- Natural Disaster:If your car is damaged beyond repair due to a natural disaster, such as a flood or hurricane, your insurance company will pay out the ACV. Nissan Gap Insurance would cover the difference between the ACV and your loan balance.

Coverage Details

Nissan Gap Insurance helps cover the difference between what your insurance pays out for your vehicle in the event of a total loss and the outstanding loan or lease balance. This coverage is designed to protect you from potential financial hardship if you find yourself owing more on your vehicle than it’s worth.

Vehicle Eligibility

Nissan Gap Insurance is generally available for new Nissan vehicles, but eligibility can vary depending on the specific model and year. It’s crucial to contact your Nissan dealer or review the official Nissan Gap Insurance program details for the most up-to-date information on eligible vehicles.

Coverage Limitations and Exclusions

Nissan Gap Insurance has specific limitations and exclusions, which are important to understand before purchasing the coverage. Here are some common limitations and exclusions:

- Coverage Duration:The coverage typically lasts for a specific period, usually tied to the length of your loan or lease. Once the coverage period expires, you’ll need to renew it if you wish to maintain the protection.

- Deductibles:Some Nissan Gap Insurance policies may have deductibles, meaning you’ll be responsible for paying a certain amount before the coverage kicks in.

- Vehicle Age:The coverage may not be available for vehicles that are too old. This is because older vehicles depreciate faster and are less likely to be worth more than the loan balance.

- Mileage:Some Nissan Gap Insurance policies may have mileage limitations, meaning the coverage may not be available if your vehicle has exceeded a certain mileage threshold.

- Total Loss Circumstances:The coverage may not apply in all cases of total loss. For instance, if the vehicle is deemed a total loss due to wear and tear, theft, or vandalism, the coverage might not be applicable.

It’s important to thoroughly read the Nissan Gap Insurance policy document to understand the complete list of limitations and exclusions. This will help you make an informed decision about whether the coverage is right for you.

Cost and Purchase Options

The cost of Nissan Gap Insurance varies depending on several factors, and there are different ways to purchase it. Understanding these aspects can help you make an informed decision.

Factors Influencing Cost

The cost of Nissan Gap Insurance is determined by various factors, including:

- Vehicle Make and Model:Certain vehicles depreciate faster than others, impacting the potential gap between the loan amount and the vehicle’s actual value.

- Vehicle Age and Mileage:Newer vehicles generally have higher insurance premiums, as they are more likely to be involved in accidents and have higher repair costs.

- Loan Amount:A larger loan amount translates to a higher gap, potentially resulting in a higher insurance premium.

- Credit Score:Individuals with good credit scores may qualify for lower premiums, as they are considered less risky by insurance companies.

- Coverage Options:The level of coverage you choose can influence the cost. For example, comprehensive coverage typically costs more than basic coverage.

Purchasing Options

Nissan Gap Insurance can be purchased through several channels:

- At the Dealership:Purchasing Gap Insurance at the dealership is a convenient option. However, it’s essential to compare prices and coverage options with other providers.

- Online:Numerous online insurance providers offer Gap Insurance, allowing you to compare quotes and choose the most suitable option.

- Through Your Insurance Agent:Your existing insurance agent may offer Gap Insurance as part of their services.

Obtaining a Quote

To obtain a quote for Nissan Gap Insurance, you typically need to provide the following information:

- Vehicle Identification Number (VIN):This unique number identifies your vehicle and helps determine its value.

- Loan Amount:The outstanding amount on your vehicle loan.

- Vehicle Age and Mileage:This information helps determine the potential depreciation of your vehicle.

- Personal Information:This includes your name, address, and contact details.

Benefits and Drawbacks

Nissan Gap Insurance can be a valuable addition to your auto insurance policy, particularly if you’re financing a new vehicle. However, it’s essential to weigh the potential benefits against the cost and consider if it’s the right choice for your individual situation.

Benefits of Nissan Gap Insurance

Nissan Gap Insurance offers several advantages for vehicle owners. These benefits can help mitigate financial risks associated with a total loss or theft of your vehicle.

- Coverage for the Difference:Gap insurance covers the difference between the actual cash value (ACV) of your vehicle and the outstanding loan balance, protecting you from potential financial losses if your car is totaled or stolen. This can be a significant benefit, especially if you have a loan with a longer term or if your vehicle depreciates quickly.

- Peace of Mind:Knowing that you have gap insurance can provide peace of mind, knowing that you’re financially protected in the event of a total loss. This can help reduce stress and financial hardship during a challenging time.

- Convenience:Purchasing Nissan Gap Insurance through the dealership is often convenient and streamlined, as it’s included as part of the vehicle purchase process. This can save you time and effort compared to shopping for gap insurance from other providers.

Alternatives to Nissan Gap Insurance

While Nissan Gap insurance can be a valuable protection, it’s not the only option available to bridge the gap between your loan value and your vehicle’s actual value in case of a total loss. Exploring alternative options can help you find the most cost-effective and suitable solution for your needs.

Other Insurance Options

Exploring alternative insurance options can provide a more comprehensive approach to protecting your vehicle’s value. These options may offer additional coverage or features that Nissan Gap insurance doesn’t provide, potentially providing greater peace of mind.

- Comprehensive and Collision Coverage:These standard auto insurance coverages typically reimburse you for the actual cash value (ACV) of your vehicle, which is its market value minus depreciation. While they don’t cover the entire gap, they can significantly reduce your out-of-pocket expenses.

- Loan/Lease Gap Insurance:Offered by various insurance providers, this type of insurance specifically covers the difference between the outstanding loan or lease balance and the actual cash value of your vehicle in case of a total loss. It operates similarly to Nissan Gap insurance, but it’s often more flexible in terms of coverage options and can be customized to suit your specific needs.

- Extended Warranty:An extended warranty, also known as a vehicle service contract, can provide coverage for repairs beyond the manufacturer’s warranty period. While it doesn’t directly address the gap between loan and vehicle value, it can help you avoid unexpected repair costs and protect your investment in your vehicle.

Financial Strategies, Nissan gap insurance coverage

Beyond traditional insurance, consider financial strategies to mitigate the financial impact of a total loss.

- High Deductible:Opting for a higher deductible on your comprehensive and collision coverage can lower your monthly premiums. This strategy allows you to save money on insurance while still having some coverage in case of an accident.

- Prepayment:Making extra payments on your auto loan can reduce the principal balance, decreasing the gap between your loan value and your vehicle’s value. This proactive approach can help you minimize the potential financial burden if your vehicle is totaled.

- Emergency Fund:Building an emergency fund can provide a financial cushion to cover unexpected expenses, including a potential gap between your loan value and your vehicle’s value in case of a total loss. Having a dedicated savings account for emergencies can provide peace of mind and reduce financial stress.

Comparison Table

Here’s a comparison table highlighting the key features, costs, and suitability of Nissan Gap insurance and alternative options:

| Feature | Nissan Gap Insurance | Comprehensive & Collision | Loan/Lease Gap Insurance | Extended Warranty | High Deductible | Prepayment | Emergency Fund |

|---|---|---|---|---|---|---|---|

| Coverage | Difference between loan value and ACV | ACV of vehicle | Difference between loan value and ACV | Repairs beyond manufacturer’s warranty | Reduced insurance premiums | Reduced loan balance | Financial cushion for unexpected expenses |

| Cost | Variable, typically added to loan | Included in auto insurance premiums | Variable, typically purchased separately | Variable, typically purchased separately | Lower monthly premiums | Extra loan payments | Requires dedicated savings |

| Suitability | For new vehicles with high loan balances | For all vehicle owners | For vehicles with high loan balances | For vehicles with potential for costly repairs | For drivers willing to pay higher out-of-pocket expenses | For drivers who can afford extra loan payments | For all individuals, especially those with high-risk vehicles |

Factors to Consider

When deciding whether Nissan Gap insurance or an alternative option is right for you, consider the following factors:

- Vehicle Age and Value:The age and value of your vehicle play a significant role in determining the gap between your loan value and its actual value. Newer vehicles with high loan balances often have a larger gap, making Gap insurance more appealing.

- Loan Term:A longer loan term can increase the gap between your loan value and your vehicle’s value, as depreciation continues over time.

- Financial Situation:Assess your financial situation and risk tolerance. If you can afford to cover a potential gap out of pocket or have a substantial emergency fund, Gap insurance may not be necessary.

Tips for Choosing Nissan Gap Insurance: Nissan Gap Insurance Coverage

Choosing Nissan Gap insurance requires careful consideration to ensure it aligns with your individual needs and financial situation. While it can provide valuable protection, it’s essential to make an informed decision. Here are some tips to help you choose wisely.

Assess Your Financial Situation and Needs

It’s crucial to assess your current financial standing and determine if Gap insurance is a necessary expense. Consider factors like your debt-to-income ratio, emergency fund, and the potential financial burden of a large loan payment.

- Debt-to-income ratio:If your debt-to-income ratio is high, Gap insurance may be less of a priority. This is because you might already be stretched financially, and the added expense of Gap insurance could put a strain on your budget.

- Emergency fund:Having a healthy emergency fund can help mitigate the risk of a large financial loss in case of a total vehicle loss. If you have a substantial emergency fund, Gap insurance may be less crucial.

- Loan amount:The larger your loan amount, the more significant the potential gap between the insurance payout and your loan balance. This makes Gap insurance more appealing for those with larger loans.

Read the Policy Documents Carefully

Understanding the terms and conditions of the policy is vital. Pay close attention to:

- Coverage details:Clarify what is covered, such as the specific types of events (e.g., accidents, theft) and the maximum coverage amount.

- Exclusions:Understand what is not covered by the policy, such as wear and tear, pre-existing damage, or specific driving situations.

- Deductibles:Determine the deductible amount you will have to pay in the event of a claim.

- Cancellation policy:Review the policy’s cancellation terms and conditions, including any potential refunds or penalties.

Compare Options and Prices

Nissan Gap insurance is just one option. It’s wise to explore alternatives and compare prices from different providers:

- Third-party providers:Consider third-party insurance providers that offer Gap insurance, as they might offer competitive prices and coverage options.

- Credit union or bank:If you financed your vehicle through a credit union or bank, they might offer Gap insurance as part of your loan package.

- Independent insurance agents:An independent insurance agent can provide personalized advice and help you compare different Gap insurance options.

Consider the Benefits and Drawbacks

While Gap insurance can offer financial protection, it’s important to weigh the potential benefits against the drawbacks:

- Benefits:Gap insurance can cover the difference between your insurance payout and the outstanding loan balance, potentially saving you from significant financial loss.

- Drawbacks:Gap insurance can be an added expense, and it might not be necessary if you have a substantial emergency fund or a lower loan amount. Additionally, it might not cover all situations, such as wear and tear or pre-existing damage.

FAQ Compilation

Is Nissan Gap Insurance mandatory?

No, Nissan Gap Insurance is not mandatory. It is an optional coverage that you can choose to purchase.

How long does Nissan Gap Insurance last?

The duration of Nissan Gap Insurance coverage typically matches the term of your car loan. However, it’s essential to review your policy documents for specific details.

Can I cancel Nissan Gap Insurance?

You may be able to cancel your Nissan Gap Insurance policy, but you may incur a cancellation fee. It’s crucial to check the terms and conditions of your policy.

What happens if I sell my car before the Nissan Gap Insurance expires?

If you sell your car before the Nissan Gap Insurance expires, you may be able to get a refund for the unused portion of the coverage. However, this depends on the specific terms of your policy.