Landlord Insurance in New Jersey

Landlord insurance new jersey – Landlord insurance in New Jersey is crucial for property owners who rent out their properties. It provides essential protection against financial losses that can arise from various risks associated with owning and managing rental properties.

Landlord insurance is a specialized type of insurance designed to safeguard landlords against financial liabilities and damages related to their rental properties. It differs from standard homeowners insurance, which is intended for owner-occupied residences. Landlord insurance policies offer comprehensive coverage tailored to the unique needs of property owners who rent out their properties.

Benefits of Landlord Insurance in New Jersey

Landlord insurance in New Jersey offers a range of benefits that can protect landlords from significant financial burdens. Here are some key advantages of securing this type of insurance:

- Protection Against Property Damage:Landlord insurance covers damages to the rental property caused by various events, such as fire, theft, vandalism, and natural disasters. This coverage ensures that landlords can repair or rebuild their properties without bearing the entire financial burden.

- Liability Coverage:Landlord insurance provides liability protection against claims filed by tenants or third parties due to injuries or property damage occurring on the rental property. This coverage protects landlords from lawsuits and potential financial settlements.

- Loss of Rental Income:If a covered event renders the rental property uninhabitable, landlord insurance can provide coverage for lost rental income. This helps landlords maintain financial stability during periods when they cannot collect rent.

- Legal Defense Costs:In the event of a lawsuit, landlord insurance covers legal defense costs, including attorney fees and court expenses. This protection is crucial for landlords facing legal disputes related to their rental properties.

Differences Between Homeowners Insurance and Landlord Insurance

Landlord insurance differs significantly from standard homeowners insurance, which is designed for owner-occupied residences. Here are some key differences:

- Coverage:Landlord insurance provides coverage specifically tailored to the risks associated with rental properties, while homeowners insurance focuses on owner-occupied residences.

- Liability Coverage:Landlord insurance offers broader liability coverage than homeowners insurance, as it accounts for the potential risks of renting out a property to tenants.

- Loss of Rental Income:Landlord insurance includes coverage for lost rental income, which is not typically covered by homeowners insurance.

- Property Value:Landlord insurance typically covers the replacement cost of the property, while homeowners insurance may cover the actual cash value, which is lower than the replacement cost.

Essential Coverages for New Jersey Landlords: Landlord Insurance New Jersey

Landlord insurance in New Jersey is crucial for protecting your financial interests and ensuring peace of mind. While not all coverages are mandatory, understanding the essential and optional coverages can help you make informed decisions about your insurance policy.

Mandatory Coverages

New Jersey law requires landlords to have certain types of insurance coverage. These mandatory coverages are designed to protect both the landlord and the property in case of specific events.

- Property Insurance:This coverage protects the physical structure of the rental property against damage from events like fire, windstorm, and vandalism. It covers the cost of repairs or rebuilding, up to the policy limits.

- Liability Insurance:This coverage protects the landlord from claims of negligence or liability arising from injuries or property damage occurring on the rental property. For example, if a tenant falls on a slippery floor and gets injured, liability insurance would cover the landlord’s legal expenses and potential settlements.

Optional Coverages

While not mandatory, several optional coverages can provide additional protection for New Jersey landlords. These coverages address specific risks and can be tailored to meet the unique needs of each property.

- Rent Loss Coverage:This coverage protects landlords from financial losses if tenants are unable to pay rent due to a covered event, such as a fire or flood. It helps ensure a consistent income stream even during unforeseen circumstances.

- Personal Property Coverage:This coverage protects the landlord’s personal belongings stored on the rental property, such as appliances, furniture, or tools. It can provide financial assistance for replacing or repairing damaged items.

- Liability Umbrella Coverage:This coverage provides additional liability protection beyond the limits of the standard liability policy. It can be particularly helpful for landlords with high-value properties or those facing potential high-risk situations.

- Flood Insurance:While not mandatory, flood insurance is essential for landlords in flood-prone areas. It covers damage to the property caused by flooding, a risk that is not typically covered by standard property insurance policies.

- Earthquake Insurance:Similar to flood insurance, earthquake insurance is an optional coverage for landlords in areas prone to seismic activity. It provides financial protection against damage caused by earthquakes, a risk not covered by standard property insurance policies.

Understanding Your Property’s Needs

When choosing landlord insurance, it is essential to consider the specific needs of your rental property. Factors to consider include:

- Property Value:The value of your property will determine the amount of coverage you need to ensure adequate protection in case of damage or loss.

- Location:The location of your property can influence the types of risks you face. For example, properties in flood-prone areas may require flood insurance, while properties in areas with high crime rates may need increased liability coverage.

- Type of Property:The type of rental property, such as a single-family home, apartment building, or commercial property, will influence the specific coverages you need.

- Tenant Profile:The type of tenants you rent to can also influence your insurance needs. For example, landlords renting to families with children may need higher liability coverage than landlords renting to single professionals.

Finding the Right Landlord Insurance in New Jersey

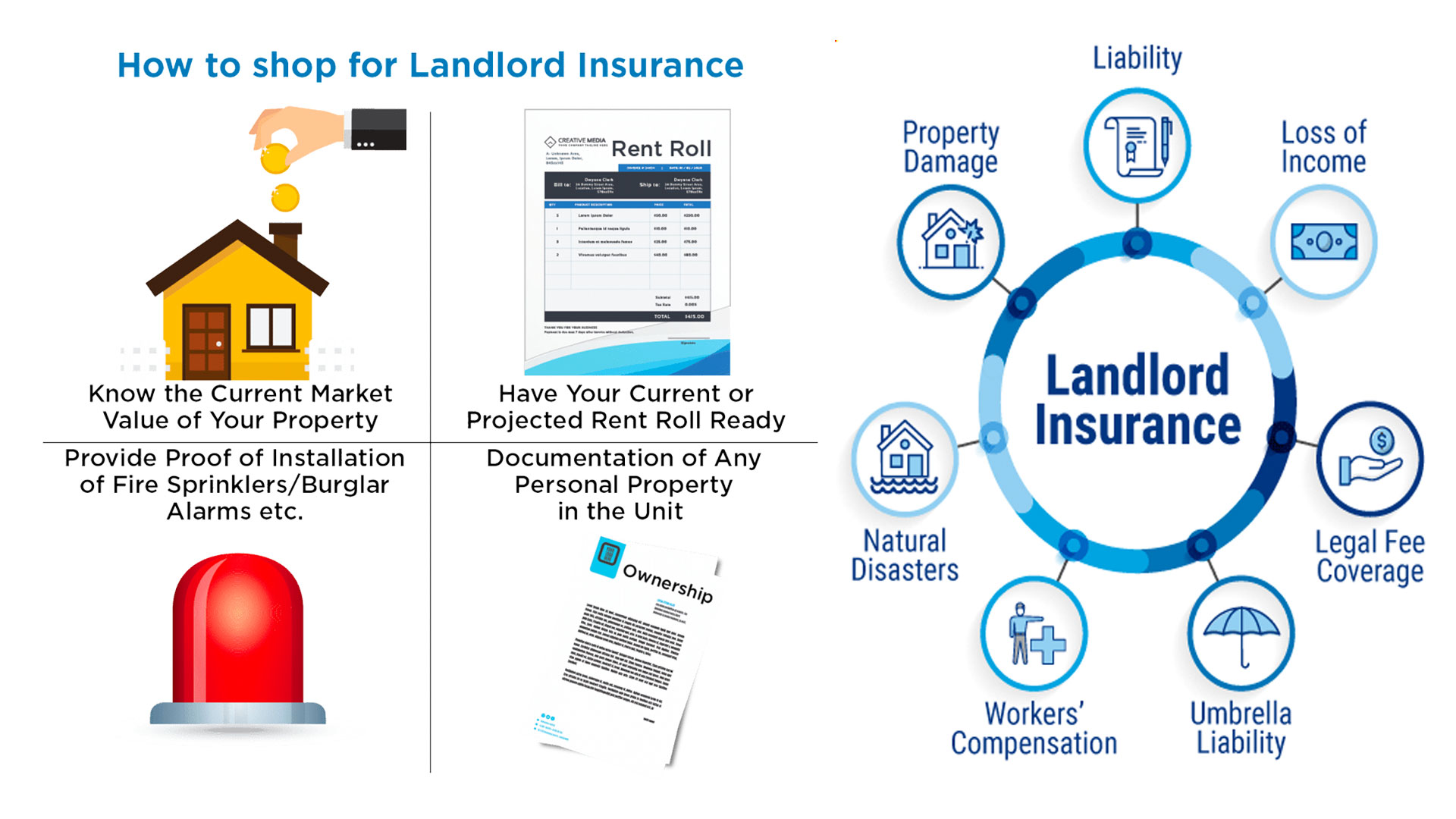

Securing the right landlord insurance in New Jersey is crucial for safeguarding your financial interests and protecting your investment. Finding the right insurance policy can be a daunting task, as there are numerous providers and plans available. However, by taking a strategic approach and understanding your needs, you can navigate this process effectively.

Landlord Insurance Checklist

A checklist can help you evaluate insurance providers and policies more effectively. Consider these factors:

- Coverage Types:Ensure the policy covers essential aspects such as property damage, liability, and loss of rental income.

- Deductibles:Higher deductibles often result in lower premiums, but you’ll have to pay more out of pocket in case of a claim.

- Limits:Understand the maximum amount the insurer will pay for each type of coverage.

- Exclusions:Be aware of specific events or situations that are not covered by the policy.

- Customer Service:Look for an insurer with a reputation for responsiveness and helpfulness.

- Financial Stability:Choose a company with a strong financial rating to ensure they can pay claims.

- Reputation:Read online reviews and seek recommendations from other landlords to gauge the insurer’s reputation.

Comparing Quotes and Policies, Landlord insurance new jersey

When comparing quotes and policies, consider these tips:

- Get Multiple Quotes:Obtain quotes from at least three different insurance providers to ensure you’re getting competitive rates.

- Compare Coverage:Carefully review the coverage details of each policy to ensure they meet your specific needs.

- Consider Deductibles:Analyze the impact of different deductible amounts on your premiums and out-of-pocket expenses.

- Ask Questions:Don’t hesitate to clarify any unclear aspects of the policy with the insurer.

Understanding Policy Terms and Conditions

Thoroughly understanding the policy terms and conditions is essential to avoid any surprises or disputes later.

- Read the Fine Print:Pay close attention to the policy’s exclusions, limitations, and conditions.

- Clarify Ambiguities:If any terms or conditions are unclear, ask the insurer for clarification.

- Seek Professional Advice:If you have complex insurance needs, consult with an insurance broker or agent for guidance.

Finding Reputable Insurance Agents or Brokers

To find reputable insurance agents or brokers in New Jersey, consider these resources:

- The New Jersey Department of Banking and Insurance:This state agency provides information on licensed insurance professionals.

- Independent Insurance Agents and Brokers of America (IIABA):This national association connects you with independent insurance agents.

- Local Real Estate Associations:These associations often have resources and recommendations for insurance providers.

- Online Reviews and Recommendations:Utilize online platforms like Yelp and Google Reviews to gather feedback from other landlords.

Landlord Insurance Claims in New Jersey

Landlord insurance claims in New Jersey are a crucial aspect of protecting your investment as a property owner. Understanding the process, documentation requirements, and common claim scenarios will help you navigate potential issues effectively.

Filing a Landlord Insurance Claim

When filing a claim, it’s essential to act promptly and follow the specific instructions Artikeld in your policy.

- Contact your insurance company immediatelyafter the incident. Most insurers have a 24/7 claims hotline for reporting emergencies.

- Provide detailed informationabout the incident, including the date, time, location, and nature of the damage or loss.

- Gather supporting documentation, such as photos, videos, repair estimates, and police reports.

- Cooperate with your insurance companyby providing requested information and attending any necessary inspections or meetings.

Documentation and Reporting

Proper documentation is essential for a smooth and successful claim process.

- Take clear and comprehensive photos or videosof the damage, including the surrounding area to establish context.

- Obtain written estimatesfor repairs or replacement costs from reputable contractors.

- Keep records of all communicationwith your insurance company, including dates, times, and content of conversations.

- Preserve any evidencerelated to the incident, such as tenant statements or witness accounts.

Common Claim Scenarios

Here are some common claim scenarios and their corresponding coverage under a typical landlord insurance policy:

| Scenario | Coverage |

|---|---|

| Fire damage to the property | Property damage coverage |

| Theft of appliances or personal property | Property damage coverage |

| Water damage from a burst pipe | Property damage coverage |

| Liability claim from a tenant injury | Liability coverage |

| Loss of rental income due to a covered event | Loss of rental income coverage |

Impact of Claim History on Premiums

Filing claims can impact your future premiums. Insurance companies consider your claim history when determining your risk profile.

- Frequent or large claimscan lead to higher premiums, as insurers view you as a higher risk.

- A clean claim historycan help you qualify for discounts and lower premiums.

- Understanding your policyand taking preventative measures can minimize the likelihood of claims.

Common Queries

What are the typical costs associated with landlord insurance in New Jersey?

Landlord insurance premiums in New Jersey vary based on several factors, including the property’s location, size, age, rental history, and the chosen coverage options. It’s recommended to obtain quotes from multiple insurance providers to compare rates and find the best value.

Is it mandatory for landlords in New Jersey to carry landlord insurance?

While not legally mandated, it’s highly recommended for landlords in New Jersey to have landlord insurance. It provides essential protection against various risks, including property damage, liability claims, and legal expenses.

How do I file a landlord insurance claim in New Jersey?

In case of a covered event, contact your insurance provider immediately to report the claim. Provide detailed information about the incident, including date, time, and any supporting documentation. Your insurer will guide you through the claim process and assist with any necessary actions.