Ken Brown’s Insurance Expertise: Insurance By Ken Brown Insurance by ken brown – Ken Brown is a seasoned professional in the insurance industry with a wealth of experience spanning several years. He has dedicated his career to understanding the complexities of insurance and providing insightful guidance to individuals and businesses …

Read More »Can You Have Life Insurance While on Medicaid?

Eligibility for Life Insurance While on Medicaid Can you have life insurance while on medicaid – Medicaid is a government-funded health insurance program for low-income individuals and families. While Medicaid helps cover healthcare costs, it does not typically cover life insurance premiums. However, individuals enrolled in Medicaid can still obtain …

Read More »Can You Have Life Insurance While on Medicaid?

Eligibility for Life Insurance While on Medicaid: Can You Have Life Insurance While On Medicaid Can you have life insurance while on medicaid – Medicaid is a government-funded health insurance program for low-income individuals and families. While Medicaid helps cover healthcare costs, it does not typically cover life insurance premiums. …

Read More »Can You Have Life Insurance While on Medicaid?

Eligibility for Life Insurance While on Medicaid Can you have life insurance while on medicaid – Medicaid is a government-funded health insurance program for low-income individuals and families. While Medicaid helps cover healthcare costs, it does not typically cover life insurance premiums. However, individuals enrolled in Medicaid can still obtain …

Read More »Can You Have Life Insurance While on Medicaid?

Eligibility for Life Insurance While on Medicaid: Can You Have Life Insurance While On Medicaid Can you have life insurance while on medicaid – Medicaid is a government-funded health insurance program for low-income individuals and families. While Medicaid helps cover healthcare costs, it does not typically cover life insurance premiums. …

Read More »When to Drop Collision Insurance: A Guide to Saving Money

Financial Factors Allintitle:when to drop collision insurance – Dropping collision insurance can be a significant financial decision, and it’s crucial to weigh the potential cost savings against the risks involved. This section explores the financial aspects of collision insurance, including its cost, the impact of deductibles, and the potential financial …

Read More »How Much Does Top Surgery Cost With Insurance?

Understanding Top Surgery Costs How much does top surgery cost with insurance – The cost of top surgery can vary significantly depending on several factors. It’s crucial to understand these factors to get a clear picture of the potential expenses involved. Factors Influencing Top Surgery Costs, How much does top …

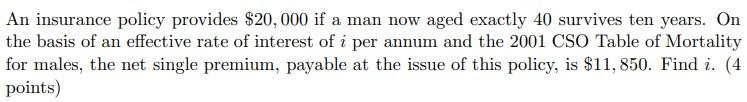

Read More »A $20,000 Life Insurance Policy Application: Completing the Process

Understanding Policy Terms and Conditions: A 20000 Life Insurance Policy Application Is Completed A 20000 life insurance policy application is completed – Before you finalize your $20,000 life insurance policy application, it’s crucial to understand the key terms and conditions involved. This knowledge will empower you to make informed decisions …

Read More »How to Sell Pet Insurance: A Comprehensive Guide

Identifying Your Target Audience How to sell pet insurance – Understanding your target audience is crucial for any marketing campaign, and selling pet insurance is no exception. Identifying the specific types of pet owners most likely to be interested in your product will help you tailor your messaging, choose the …

Read More »Medicaid and Life Insurance: A Comprehensive Guide

Medicaid Eligibility and Life Insurance Medicaid and life insurance – Medicaid, a government-funded health insurance program, provides coverage to low-income individuals and families. Eligibility for Medicaid varies from state to state and is based on factors such as income, assets, and family size. The interplay between Medicaid eligibility and life …

Read More »5 Million Life Insurance Policy: A Comprehensive Guide

Understanding a $5 Million Life Insurance Policy A $5 million life insurance policy represents a substantial financial commitment, providing a significant death benefit to your beneficiaries upon your passing. This type of policy is typically sought by individuals with substantial wealth, complex financial situations, or significant dependents who rely on …

Read More »