What is E&O Insurance?

/GettyImages-1134608647-d06eff10dc3746119683550068860dae.jpg)

E&o insurance for travel agents – E&O insurance, also known as errors and omissions insurance, is a crucial type of liability insurance specifically designed to protect professionals from financial losses arising from claims of negligence, errors, or omissions in their professional services. In the travel industry, E&O insurance is particularly important for travel agents, as they play a significant role in arranging travel itineraries and managing client expectations.E&O insurance provides a safety net for travel agents by covering them against potential lawsuits or claims from clients who experience problems during their trips, such as flight delays, hotel cancellations, or mishaps related to travel arrangements.

It helps protect travel agents from financial ruin in situations where they are held liable for mistakes or omissions in their professional duties.

Types of Risks Covered by E&O Insurance for Travel Agents

E&O insurance for travel agents typically covers a broad range of risks associated with their professional services. This coverage includes:

- Misinformation or Incorrect Information:Providing inaccurate or incomplete information about travel destinations, accommodations, transportation, or other travel arrangements.

- Negligence in Booking or Planning:Failing to properly book flights, hotels, or other travel arrangements, resulting in cancellations, delays, or other inconveniences.

- Failure to Advise on Travel Regulations:Not informing clients about necessary travel documents, visa requirements, or other travel regulations.

- Misrepresentation of Services:Exaggerating or misrepresenting the quality, amenities, or services of hotels, resorts, or other travel providers.

- Breach of Contract:Failing to fulfill the terms of a travel contract, such as providing promised services or refunds.

- Privacy Violations:Improperly handling or disclosing client information, such as credit card details or personal data.

Examples of Situations Where E&O Insurance Would Be Beneficial

Here are some examples of situations where E&O insurance would be beneficial for travel agents:

- A client experiences a flight cancellation due to a travel agent’s error in booking.The client may sue the travel agent for financial losses, inconvenience, and emotional distress. E&O insurance would cover the travel agent’s legal defense costs and any financial settlements.

- A client discovers that the hotel they booked through a travel agent does not have the amenities or services they were promised.The client may claim that the travel agent misrepresented the hotel and seek compensation for their disappointment. E&O insurance would provide coverage for the travel agent in such a situation.

- A travel agent fails to inform a client about necessary visa requirements for their destination.The client is denied entry at the border and incurs significant expenses for cancelled flights and accommodations. E&O insurance would cover the travel agent’s liability for this omission.

Why Travel Agents Need E&O Insurance: E&o Insurance For Travel Agents

Travel agents are professionals who play a crucial role in helping people plan and book their vacations. They handle various aspects of travel arrangements, from booking flights and accommodations to organizing tours and activities. While travel agents strive to provide exceptional service, they are not immune to errors or omissions that can lead to significant financial losses and legal liabilities.

This is where E&O insurance becomes indispensable, providing essential protection for travel agents against potential risks.

Potential Legal Liabilities Faced by Travel Agents

Travel agents can face legal liabilities due to various factors, including:

- Incorrect or incomplete travel information:Providing inaccurate or incomplete information about destinations, accommodations, or travel requirements can lead to client dissatisfaction and legal action.

- Misleading or deceptive advertising:Misrepresenting travel packages, services, or pricing can result in legal claims for false advertising.

- Booking errors:Mistakes in booking flights, hotels, or tours can lead to inconvenience, financial losses, and potential lawsuits.

- Negligence in safety and security:Failure to provide adequate safety information or warnings about potential risks in destinations can result in liability for injuries or accidents.

- Privacy breaches:Mishandling client data, such as passport information or credit card details, can lead to serious legal consequences.

Real-World Examples of Travel Agent Negligence and Resulting Lawsuits

Real-world examples highlight the importance of E&O insurance for travel agents.

- A travel agent failed to inform a client about a mandatory visa requirement for their destination. The client was denied entry and incurred significant financial losses due to canceled flights and accommodations. The client sued the travel agent for negligence and was awarded damages.

- A travel agent booked a client on a flight with a connecting flight that was too short, resulting in a missed connection and delayed arrival. The client suffered financial losses and inconvenience, and filed a lawsuit against the travel agent for negligence.

- A travel agent failed to warn a client about a potential security risk in their destination. The client was robbed during their trip and incurred financial losses due to stolen belongings. The client sued the travel agent for negligence and lack of due diligence.

How E&O Insurance Protects Travel Agents from Financial Losses, E&o insurance for travel agents

E&O insurance provides financial protection to travel agents against claims arising from errors, omissions, or negligence in their professional services.

- Covers legal defense costs:E&O insurance covers the costs of legal defense, including attorney fees and court costs, in the event of a lawsuit.

- Pays settlements or judgments:If a claim is found to be valid, E&O insurance will pay settlements or judgments awarded to the claimant, up to the policy limits.

- Provides peace of mind:Having E&O insurance gives travel agents peace of mind knowing they are protected against potential financial losses and legal liabilities.

E&O insurance is essential for travel agents to protect themselves from the financial risks associated with potential legal liabilities.

Key Coverage Areas of E&O Insurance

E&O insurance for travel agents is designed to protect them from financial losses arising from professional negligence or errors in their services. It acts as a safety net, covering a range of potential risks associated with the travel industry.This type of insurance offers broad coverage, encompassing various aspects of a travel agent’s duties.

Here are some of the key coverage areas:

Types of Claims Covered by E&O Insurance

E&O insurance for travel agents provides coverage for a wide range of claims that can arise from professional negligence or errors in service.

- Misrepresenting travel information:This includes providing inaccurate information about destinations, accommodations, transportation, or travel packages, leading to a client’s dissatisfaction or financial loss.

- Failing to book travel arrangements properly:This can involve errors in booking flights, hotels, or other travel services, resulting in cancellations, delays, or additional expenses for the client.

- Neglecting to inform clients of important travel details:This could involve omitting essential information about visa requirements, health regulations, or travel advisories, leading to problems for the client during their trip.

- Failing to provide adequate advice:This may include failing to recommend suitable travel insurance or neglecting to inform clients about potential risks associated with their chosen destination, resulting in unforeseen issues during their trip.

- Breaching confidentiality:This can involve disclosing sensitive client information, such as financial details or travel preferences, to unauthorized individuals or entities.

- Violating travel regulations:This could involve booking travel arrangements that do not comply with local regulations or failing to obtain necessary permits or authorizations, leading to legal consequences for the client or the travel agent.

- Providing substandard travel services:This can include booking accommodations that do not meet the client’s expectations or offering travel packages that are not value for money, leading to client dissatisfaction and potential legal claims.

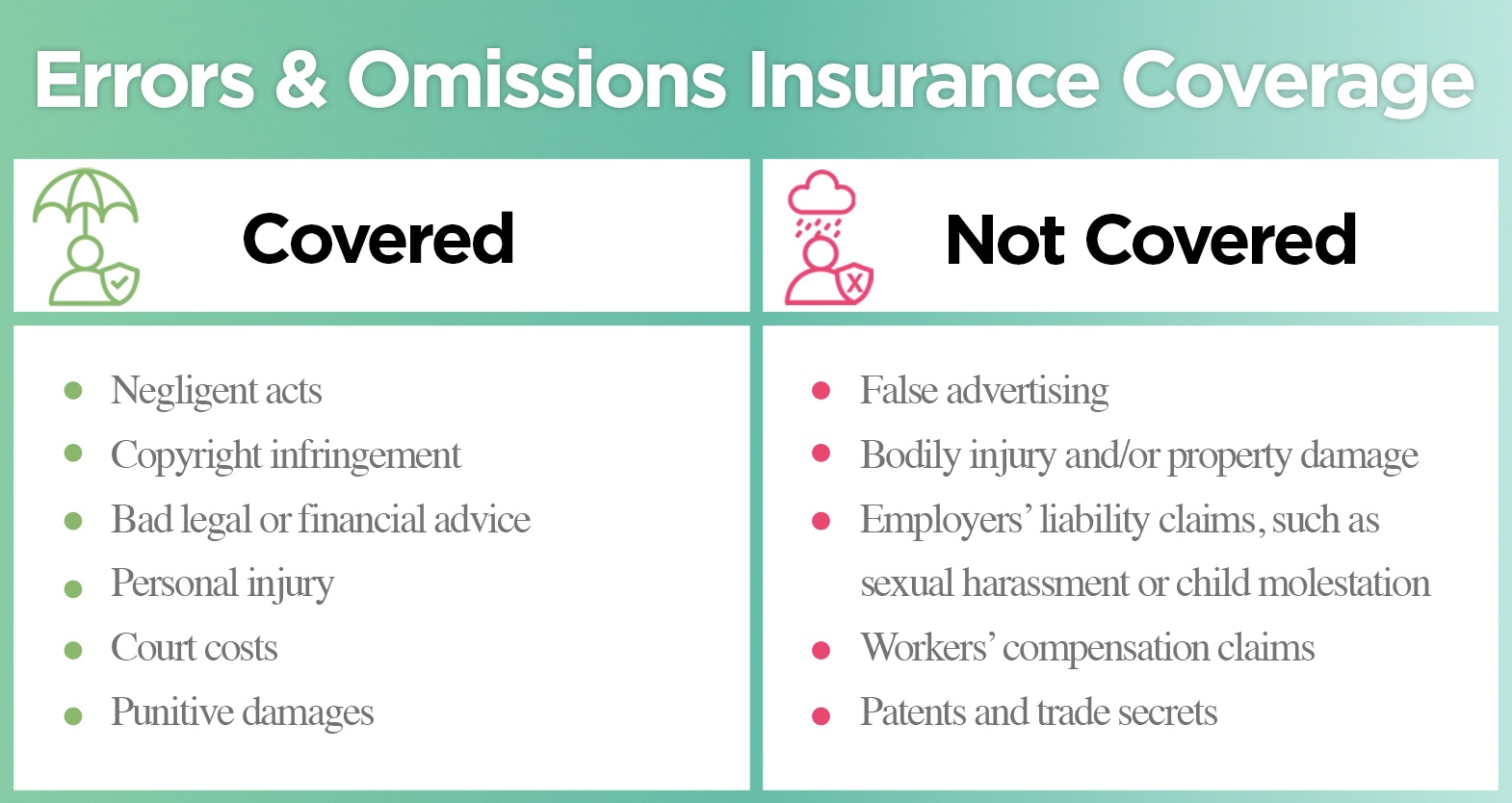

Limits of Coverage and Exclusions

While E&O insurance provides valuable protection for travel agents, it’s essential to understand the limits of coverage and any exclusions in the policy.

- Policy Limits:E&O policies typically have a limit on the amount of coverage they provide. This limit represents the maximum amount the insurer will pay for a single claim or for all claims within a policy period. Travel agents should choose a policy limit that aligns with their potential exposure to risk.

- Deductibles:Most E&O policies have a deductible, which is the amount the travel agent must pay out-of-pocket before the insurance coverage kicks in. The deductible can vary depending on the policy and the agent’s risk profile.

- Exclusions:E&O policies typically exclude coverage for certain types of claims, such as intentional acts of negligence, criminal acts, or claims arising from events beyond the travel agent’s control, such as natural disasters or political unrest.

Choosing the Right E&O Insurance Policy

Selecting the appropriate E&O insurance policy is crucial for travel agents to safeguard their business and finances against potential risks. A well-chosen policy provides peace of mind and financial protection in the event of a claim.

Factors to Consider When Selecting an E&O Insurance Policy

It’s important to consider several factors when choosing an E&O insurance policy. These factors will help you make an informed decision that aligns with your specific needs and budget.

- Coverage Limits: The coverage limit represents the maximum amount the insurer will pay for a single claim or in total during the policy period. Determine the appropriate coverage limit based on your typical transaction values and potential exposure to claims.

- Deductible: The deductible is the amount you pay out-of-pocket before the insurance coverage kicks in. A higher deductible usually translates to lower premiums. Consider your risk tolerance and financial capacity when choosing a deductible.

- Policy Exclusions: Carefully review the policy’s exclusions, which specify situations not covered by the insurance. Understanding these exclusions helps you avoid potential gaps in coverage.

- Claims History: Your past claims history can influence your premiums. A clean claims history may qualify you for lower rates, while frequent claims could lead to higher premiums.

- Reputation of the Insurer: Research the insurer’s reputation and financial stability. Look for insurers with a strong track record of handling claims fairly and efficiently.

- Customer Service: Consider the insurer’s customer service quality. Look for insurers with responsive and helpful customer support teams.

Comparing E&O Insurance Providers and Coverage Options

Comparing different E&O insurance providers and their coverage options is essential to find the best fit for your travel agency.

- Coverage Options: Different insurers offer various coverage options, such as coverage for errors and omissions, negligence, breach of contract, and other related liabilities. Compare the coverage options to ensure they align with your specific risks.

- Premiums: Obtain quotes from multiple insurers to compare premiums. Consider the coverage offered and the insurer’s reputation when comparing premiums.

- Policy Terms and Conditions: Carefully review the policy terms and conditions before signing. Understand the definitions of key terms, exclusions, and limitations of coverage.

Understanding the Policy’s Terms and Conditions

Understanding the policy’s terms and conditions is crucial to avoid surprises later.

- Definitions: Familiarize yourself with the definitions of key terms used in the policy.

- Exclusions: Pay close attention to the policy’s exclusions, which specify situations not covered by the insurance.

- Limitations: Understand any limitations on coverage, such as maximum coverage limits or specific timeframes for filing claims.

Managing E&O Insurance Costs

E&O insurance is a vital investment for travel agents, safeguarding them from potential financial losses due to errors, omissions, or negligence. However, minimizing the cost of E&O insurance premiums while maintaining adequate coverage is crucial for maintaining profitability. This section will explore strategies to manage E&O insurance costs effectively, focusing on reducing premiums and mitigating the risk of claims.

Strategies for Minimizing E&O Insurance Premiums

Travel agents can significantly impact their E&O insurance premiums by adopting proactive measures. Here are some effective strategies:

- Maintain a Clean Claims History:A spotless claims record is a powerful bargaining chip when negotiating premiums. By minimizing errors and omissions, agents can demonstrate a low-risk profile, potentially leading to discounted rates.

- Enhance Risk Management Practices:Implementing robust risk management procedures can significantly reduce the likelihood of claims. This includes thorough client communication, accurate record-keeping, and adherence to industry best practices.

- Increase Your Limits:Higher limits of liability can sometimes result in lower premiums. This seemingly counterintuitive concept stems from the insurer’s assessment of risk. By demonstrating a willingness to cover significant claims, agents can signal a greater commitment to responsible practices, potentially leading to reduced premiums.

- Bundle Policies:Combining E&O insurance with other business insurance policies, such as general liability or property insurance, can often result in discounts. This bundled approach can streamline insurance management and potentially reduce overall costs.

- Shop Around for Quotes:Regularly comparing quotes from multiple reputable insurance providers is essential. Different insurers have varying pricing structures and risk assessments, so obtaining multiple quotes can reveal more competitive options.

Strategies for Reducing the Risk of Claims and Potential Liabilities

Preventing claims is the most effective way to manage E&O insurance costs. By proactively mitigating risks, travel agents can significantly reduce the likelihood of facing lawsuits or settlements. Here are some strategies:

- Comprehensive Client Communication:Clear and detailed communication with clients is paramount. This includes providing accurate information about travel itineraries, accommodations, and any potential risks or limitations.

- Thorough Record-Keeping:Maintaining meticulous records of all interactions, bookings, and client communications is essential. This documentation can be crucial in defending against claims and demonstrating due diligence.

- Compliance with Industry Standards:Adhering to industry best practices and regulations is vital. This includes staying informed about changes in travel laws, regulations, and consumer protection guidelines.

- Professional Development:Continuous professional development ensures agents stay up-to-date on industry trends, best practices, and legal requirements. This ongoing education can help mitigate risks and prevent errors.

- Use of Technology:Implementing technology solutions, such as online booking systems and automated communication tools, can streamline processes and reduce the potential for errors.

Impact of a Good Track Record and Risk Management Practices on Insurance Costs

A strong track record and robust risk management practices directly influence E&O insurance costs. Insurers view agents with a clean claims history and well-defined risk management procedures as lower-risk clients. This favorable perception often translates into lower premiums and more favorable coverage terms.

Conversely, agents with a history of claims or inadequate risk management practices may face higher premiums or even difficulty obtaining insurance.

E&O Insurance for Specific Travel Agent Services

E&O insurance is essential for travel agents, protecting them from financial losses arising from errors, omissions, or negligence. However, the specific coverage needs of travel agents can vary depending on the services they provide. This section delves into the E&O insurance requirements for different travel agent services.

E&O Insurance Needs for Specific Travel Agent Services

Travel agents offer a wide range of services, each with its unique set of potential risks. Understanding these risks is crucial for obtaining adequate E&O insurance coverage. The following table Artikels the key E&O risks and recommended coverage levels for various travel agent services:

| Service Type | Key E&O Risks | Recommended Coverage Levels |

|---|---|---|

| Cruise Bookings |

|

$1 million to $2 million per occurrence, with an aggregate limit of $2 million to $5 million. |

| Airfare Bookings |

|

$1 million to $2 million per occurrence, with an aggregate limit of $2 million to $5 million. |

| Hotel Reservations |

|

$1 million to $2 million per occurrence, with an aggregate limit of $2 million to $5 million. |

| Tour Packages |

|

$2 million to $5 million per occurrence, with an aggregate limit of $5 million to $10 million. |

| Destination Weddings |

|

$2 million to $5 million per occurrence, with an aggregate limit of $5 million to $10 million. |

| Luxury Travel |

|

$5 million to $10 million per occurrence, with an aggregate limit of $10 million to $20 million. |

Travel agents should consult with an insurance broker to determine the appropriate coverage levels for their specific business needs and services offered.

Resources for Travel Agents

Navigating the world of E&O insurance can be overwhelming, especially for travel agents. Fortunately, there are various resources available to help you understand the nuances of this essential coverage and make informed decisions.

Reputable E&O Insurance Providers

Finding the right E&O insurance provider is crucial. Look for companies specializing in travel agents and offering comprehensive coverage tailored to your specific needs. Here are some reputable E&O insurance providers for travel agents:

- Travel Insurance Services: This company offers a wide range of insurance products for travel agents, including E&O insurance, and has a strong reputation for providing excellent customer service.

- Travel Leaders Group: As a leading travel agency network, Travel Leaders Group provides E&O insurance as a benefit to its members.

- Aon: A global insurance brokerage firm, Aon offers specialized E&O insurance programs for travel agents and other travel industry professionals.

- Marsh: Another global insurance brokerage firm, Marsh provides comprehensive E&O insurance solutions for travel agents, including risk management and consulting services.

- Arthur J. Gallagher: This insurance brokerage firm offers a wide range of insurance products for travel agents, including E&O insurance, and has a strong track record in the industry.

Industry Associations and Resources

Industry associations and resources can provide valuable insights and guidance on E&O insurance. These organizations often offer educational materials, webinars, and networking opportunities to help travel agents stay informed about the latest developments in the industry.

- American Society of Travel Agents (ASTA): ASTA offers resources and guidance on E&O insurance for its members, including information on choosing the right policy and managing costs.

- National Tour Association (NTA): NTA provides resources and support for tour operators and travel agents, including information on E&O insurance and risk management.

- Travel Insurance Institute (TII): TII offers educational resources and information on various aspects of travel insurance, including E&O insurance for travel agents.

Relevant Articles and Publications

Staying informed about E&O insurance is essential. Here are some resources that provide valuable insights and guidance for travel agents:

- Travel Agent Magazine: This industry publication regularly features articles and insights on E&O insurance for travel agents, covering topics such as policy selection, claims management, and industry trends.

- Travel Weekly: Travel Weekly also offers articles and resources on E&O insurance, providing practical advice and guidance for travel agents.

- Insurance Journal: This publication covers industry news and trends, including articles on E&O insurance for various industries, including travel.

Expert Answers

What is the difference between E&O insurance and general liability insurance?

E&O insurance specifically covers errors and omissions made in professional services, while general liability insurance protects against accidents or injuries that occur on your premises or during your business operations.

How much does E&O insurance for travel agents cost?

The cost of E&O insurance varies depending on factors such as your business size, coverage limits, and risk profile. It’s recommended to obtain quotes from multiple providers to compare pricing and coverage options.

Can I purchase E&O insurance online?

While some insurance providers offer online quotes and applications, it’s often best to consult with a qualified insurance broker who specializes in travel agent insurance. They can help you determine the right coverage and ensure you understand the policy’s terms and conditions.

What happens if I make a claim on my E&O insurance policy?

If you need to file a claim, your insurance provider will investigate the situation and determine if it’s covered under your policy. They will handle the legal and financial aspects of the claim, protecting you from potential financial losses.