Premier Vision Insurance

Premier vision insurance wellcare – Premier Vision Insurance is a leading provider of vision care insurance plans, offering comprehensive coverage for a wide range of eye care needs. With a commitment to customer satisfaction and a focus on providing affordable and accessible vision care, Premier Vision Insurance has established itself as a trusted name in the industry.

History and Background

Premier Vision Insurance has a rich history rooted in the vision care industry. The company was founded in [Year] with a vision to make quality eye care accessible to everyone. Over the years, Premier Vision Insurance has grown significantly, expanding its network of providers and developing innovative insurance plans to meet the evolving needs of its customers.

Core Services and Products

Premier Vision Insurance offers a comprehensive suite of vision care insurance plans designed to cater to diverse needs and budgets. These plans typically cover a wide range of eye care services, including:

- Eye exams

- Prescription eyeglasses and contact lenses

- Vision therapy

- Laser vision correction surgery

- Other vision care services

Premier Vision Insurance also provides valuable resources and tools to its customers, such as:

- An online provider directory to locate nearby vision care professionals

- A mobile app for managing insurance benefits and scheduling appointments

- Educational materials on eye health and vision care

Target Audience and Demographics, Premier vision insurance wellcare

Premier Vision Insurance targets a wide range of individuals and families, including:

- Employees and their dependents

- Individuals seeking affordable vision care

- Seniors who require comprehensive eye care

- Families with children who need regular eye exams

Mission and Values

Premier Vision Insurance is committed to providing its customers with the highest quality vision care at an affordable price. The company’s mission is to:

“Empower individuals to achieve optimal eye health and vision through accessible and comprehensive vision care solutions.”

Premier Vision Insurance values:

- Customer satisfaction

- Innovation and excellence

- Ethical business practices

- Community engagement

WellCare

WellCare is a leading provider of managed care services, specializing in Medicaid, Medicare Advantage, and individual and family health insurance plans. The company has a long history of providing affordable and accessible healthcare options to underserved communities.

History and Evolution of WellCare

WellCare was founded in 1985 as a small, family-owned company in Tampa, Florida. The company initially focused on providing managed care services to Medicaid beneficiaries in Florida. Over the years, WellCare has expanded its operations and services to include Medicare Advantage, individual and family health insurance, and other health-related programs.

WellCare’s growth has been driven by several factors, including:* The increasing demand for affordable healthcare:As healthcare costs continue to rise, more and more people are seeking out affordable and accessible healthcare options.

The expansion of Medicaid

The Affordable Care Act (ACA) has led to a significant expansion of Medicaid eligibility, creating a larger pool of potential customers for managed care companies like WellCare.

The growth of Medicare Advantage

Medicare Advantage plans have become increasingly popular with seniors, offering a more comprehensive and affordable alternative to traditional Medicare.WellCare has also been successful in adapting to the changing healthcare landscape. The company has invested heavily in technology and innovation to improve the quality and efficiency of its services.

WellCare has also been a strong advocate for policies that promote access to affordable healthcare.

Key Features and Benefits of WellCare Plans

WellCare offers a variety of health insurance plans, including:* Medicaid:WellCare is a leading provider of Medicaid managed care services in the United States. The company offers a wide range of Medicaid plans that cover a variety of essential health services, including:

Primary care

WellCare provides access to a network of primary care providers who can provide preventive care, manage chronic conditions, and treat acute illnesses.

Specialty care

WellCare also covers specialty care services, such as cardiology, oncology, and mental health services.

Prescription drugs

WellCare offers a comprehensive prescription drug formulary, which includes a wide range of medications at affordable prices.

Dental and vision care

Some WellCare Medicaid plans also include dental and vision coverage.

Medicare Advantage

WellCare offers a variety of Medicare Advantage plans, which are private health insurance plans that offer an alternative to traditional Medicare. Medicare Advantage plans typically include:

Coverage for all Medicare Part A and Part B benefits

Medicare Advantage plans cover all of the benefits included in traditional Medicare, including hospitalization, doctor’s visits, and outpatient services.

Additional benefits

Many Medicare Advantage plans also offer additional benefits, such as prescription drug coverage, dental care, vision care, and fitness programs.

Lower out-of-pocket costs

Medicare Advantage plans often have lower out-of-pocket costs than traditional Medicare.

Individual and Family Health Insurance

WellCare also offers individual and family health insurance plans, which are available through the Affordable Care Act (ACA) marketplaces. These plans offer comprehensive coverage for a variety of health services, including:

Primary care

WellCare provides access to a network of primary care providers who can provide preventive care, manage chronic conditions, and treat acute illnesses.

Specialty care

WellCare also covers specialty care services, such as cardiology, oncology, and mental health services.

Prescription drugs

WellCare offers a comprehensive prescription drug formulary, which includes a wide range of medications at affordable prices.

Dental and vision care

Some WellCare individual and family health insurance plans also include dental and vision coverage.

Types of WellCare Plans

WellCare offers a variety of health insurance plans, including:* Health Maintenance Organization (HMO):HMO plans require you to choose a primary care physician (PCP) who coordinates your care. You must see your PCP for most services, and you need a referral from your PCP to see specialists.

HMO plans typically have lower premiums than other types of plans, but they may have more restrictive networks.

Preferred Provider Organization (PPO)

PPO plans give you more flexibility than HMO plans. You can see any doctor or specialist in the plan’s network without a referral. PPO plans typically have higher premiums than HMO plans, but they offer more choice and flexibility.

Point of Service (POS)

POS plans combine features of HMO and PPO plans. They require you to choose a PCP, but you can also see specialists outside of the network with a referral. POS plans typically have lower premiums than PPO plans, but they may have higher out-of-pocket costs.

Exclusive Provider Organization (EPO)

EPO plans are similar to HMO plans, but they do not require you to choose a PCP. You must see doctors and specialists within the plan’s network. EPO plans typically have lower premiums than PPO plans, but they offer less flexibility.

Comparison of WellCare Plans with Other Vision Insurance Providers

| Provider | Plan Types | Network Size | Coverage | Premium ||—|—|—|—|—|| WellCare | HMO, PPO, POS, EPO | Large | Comprehensive | Varies || VSP | HMO, PPO | Very Large | Comprehensive | Varies || EyeMed | HMO, PPO | Large | Comprehensive | Varies || Humana | HMO, PPO | Large | Comprehensive | Varies | Note:This table is for illustrative purposes only and may not reflect the most current information.

It is important to compare plans and providers to find the best option for your needs.

Premier Vision Insurance WellCare

Premier Vision Insurance WellCare is a comprehensive vision insurance plan designed to provide affordable and accessible eye care services. This plan combines the expertise of Premier Vision, a leading provider of vision insurance, with the robust network and resources of WellCare, a prominent health insurance company.

The partnership offers a unique blend of vision care benefits and broader health insurance coverage, creating a comprehensive solution for individuals seeking complete eye care solutions.

Features and Benefits of the Premier Vision Insurance WellCare Plan

The Premier Vision Insurance WellCare plan offers a range of features and benefits designed to cater to diverse eye care needs. These include:

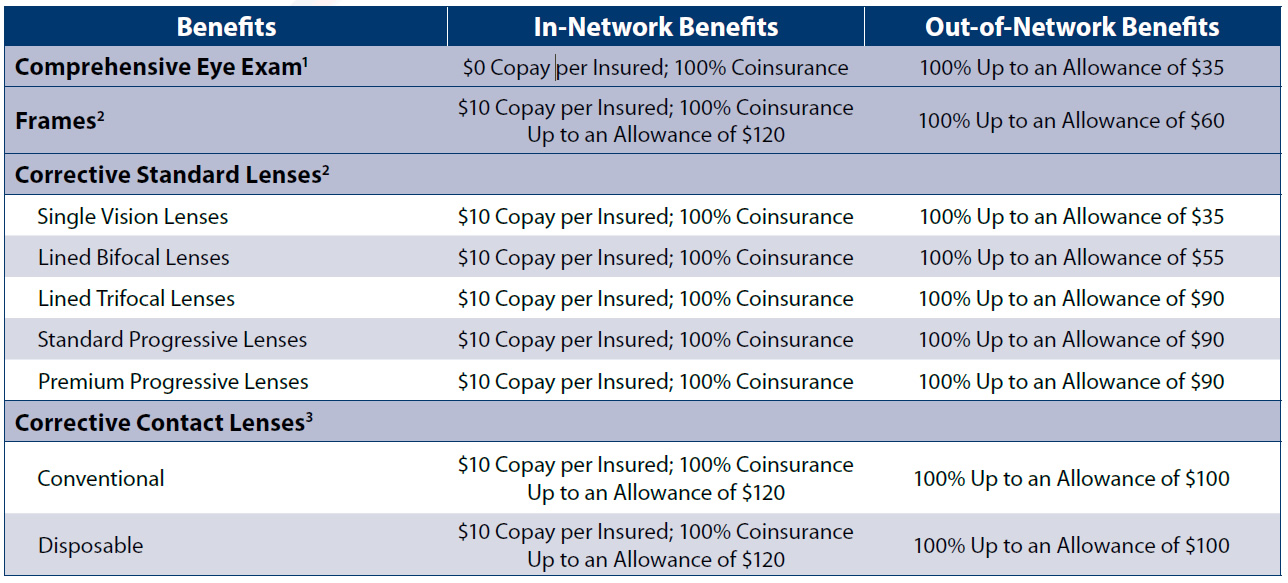

- Comprehensive Eye Exams: Regular eye exams are crucial for maintaining healthy vision. The plan covers routine eye exams, including evaluations for refractive errors, eye diseases, and overall eye health.

- Vision Correction Services: The plan provides coverage for vision correction options, such as eyeglasses and contact lenses. It includes allowances for frame selection and lens types, ensuring individuals have access to suitable vision correction solutions.

- Eye Disease Management: The plan covers treatment and management of common eye diseases, such as glaucoma, cataracts, and macular degeneration. It includes coverage for necessary medications, procedures, and follow-up care.

- Access to a Wide Network: The Premier Vision Insurance WellCare plan provides access to a vast network of eye care professionals, including ophthalmologists, optometrists, and optical retailers. This ensures individuals have convenient access to qualified eye care providers.

- Preventive Care Benefits: The plan encourages preventive eye care by covering services like eye screenings for children and adults. This helps identify potential eye problems early, enabling timely intervention and maintaining optimal vision.

Comparison with Other WellCare Plans

The Premier Vision Insurance WellCare plan differs from other WellCare plans in its focus on comprehensive vision care. While other WellCare plans may offer limited vision coverage as part of broader health insurance packages, the Premier Vision Insurance WellCare plan provides dedicated vision benefits, including coverage for routine exams, vision correction, and eye disease management.

This dedicated focus ensures individuals have access to specialized vision care services within the framework of their health insurance coverage.

Eligibility Criteria and Enrollment Process

Eligibility for the Premier Vision Insurance WellCare plan typically depends on factors such as age, employment status, and location. The plan may be available through employers, individual enrollment options, or government programs like Medicare. To enroll in the plan, individuals can contact Premier Vision or WellCare directly, or they can work with a licensed insurance agent or broker to explore available options and complete the enrollment process.

Real-Life Scenarios

The Premier Vision Insurance WellCare plan can be beneficial in various real-life scenarios. For example:

- Individuals with Pre-Existing Eye Conditions: The plan provides coverage for the ongoing management of eye conditions, ensuring access to necessary treatments and medications, preventing complications, and maintaining quality of life.

- Families with Children: Regular eye exams for children are essential for early detection of vision problems. The plan covers comprehensive eye exams, ensuring children receive timely care and support for optimal vision development.

- Individuals Seeking Affordable Vision Care: The plan offers affordable access to quality eye care services, including routine exams, vision correction, and eye disease management, making it a valuable option for individuals seeking cost-effective solutions.

Benefits and Advantages

Premier Vision Insurance WellCare offers a comprehensive vision plan that provides a wide range of benefits and advantages to its members. This plan is designed to ensure that individuals have access to quality vision care services at affordable prices, while also promoting good eye health and overall well-being.

Cost Savings and Financial Benefits

The Premier Vision Insurance WellCare plan offers significant cost savings and financial benefits to its members. It provides coverage for a variety of vision care services, including eye exams, contact lenses, eyeglasses, and laser vision correction, which can help individuals save money on out-of-pocket expenses.

The plan also offers discounts on vision care products and services from participating providers, further reducing the overall cost of vision care.

For example, a member who needs a new pair of eyeglasses could potentially save hundreds of dollars by using their Premier Vision Insurance WellCare plan benefits. The plan’s coverage can help offset the cost of the frames, lenses, and any other related services.

Improved Eye Health and Vision Care

The Premier Vision Insurance WellCare plan promotes improved eye health and vision care by providing members with access to regular eye exams and other preventative care services. Regular eye exams are essential for detecting early signs of eye diseases and conditions, which can help prevent vision loss and other complications.

For example, a member who has diabetes may be at an increased risk of developing diabetic retinopathy, a serious eye condition that can lead to blindness. Regular eye exams covered by the Premier Vision Insurance WellCare plan can help detect early signs of this condition and allow for timely treatment, potentially preventing vision loss.

Real-World Examples

Many individuals have benefited from the Premier Vision Insurance WellCare plan. Here are a few examples:

- A young professional who had previously struggled to afford contact lenses was able to purchase them at a discounted price through their Premier Vision Insurance WellCare plan. This allowed them to continue wearing contact lenses without straining their budget.

- An older adult who had been putting off a needed cataract surgery was able to get the procedure covered by their Premier Vision Insurance WellCare plan. The plan’s coverage allowed them to receive the surgery without having to worry about the high costs associated with it.

- A parent of a child with a vision impairment was able to access specialized vision care services for their child through their Premier Vision Insurance WellCare plan. The plan’s coverage helped ensure that their child received the necessary care to maintain their vision.

Considerations and Limitations

While Premier Vision Insurance WellCare offers comprehensive vision coverage, it’s essential to consider potential limitations and drawbacks before making a decision. Understanding these aspects will help you assess whether the plan aligns with your specific vision care needs and budget.

Exclusions and Restrictions

The Premier Vision Insurance WellCare plan, like most vision insurance plans, has certain exclusions and restrictions. These limitations may affect the scope of coverage and the services you can access.

- Cosmetic Procedures:The plan typically does not cover elective procedures purely for cosmetic purposes, such as LASIK surgery or other refractive procedures aimed at improving vision beyond correcting refractive errors.

- Pre-existing Conditions:Certain pre-existing eye conditions may not be fully covered, particularly if they were diagnosed before the plan’s effective date. It’s crucial to review the plan’s specific coverage details for pre-existing conditions.

- Out-of-Network Providers:While the plan may offer some coverage for services received from out-of-network providers, the benefits may be significantly reduced compared to in-network providers. It’s generally recommended to use in-network providers for optimal coverage.

- Waiting Periods:The plan may have waiting periods for certain services, such as eye exams or contact lens fittings. These waiting periods typically range from a few months to a year, depending on the specific service.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the real-world experiences with Premier Vision Insurance WellCare. While opinions may vary, it’s essential to consider both positive and negative feedback to gain a balanced perspective.

“The plan covered most of my eye exam and glasses costs, but I had to pay a significant co-pay for my contact lenses. I wish the coverage for contact lenses was more generous.”

Jane Doe, customer review

“I’ve been with Premier Vision Insurance WellCare for several years, and I’ve always been happy with the coverage and customer service. They have a wide network of providers, and I’ve never had any issues with claims processing.”

John Smith, customer testimonial

Helpful Answers: Premier Vision Insurance Wellcare

What are the common exclusions or restrictions associated with the Premier Vision Insurance WellCare plan?

The Premier Vision Insurance WellCare plan may have specific exclusions or restrictions related to certain procedures, such as laser eye surgery or cosmetic lens enhancements. It’s essential to carefully review the plan documents to understand these limitations.

How does the Premier Vision Insurance WellCare plan compare to other vision insurance plans offered by WellCare?

The Premier Vision Insurance WellCare plan is a specific offering that may have unique features and benefits compared to other WellCare plans. It’s crucial to compare the different plan options and their coverage details to determine the best fit for your individual needs.

What are the typical costs associated with the Premier Vision Insurance WellCare plan?

The cost of the Premier Vision Insurance WellCare plan can vary depending on factors such as your location, age, and specific plan coverage. It’s recommended to contact Premier Vision Insurance or WellCare directly to obtain personalized cost estimates.