The Impact of Driver’s Education on Car Insurance

How much does drivers ed save you on insurance – Driver’s education is a valuable investment for young drivers and their families, as it can significantly reduce the cost of car insurance. Insurance companies are acutely aware of the risks associated with inexperienced drivers, and they factor this into their premium calculations.

Therefore, completing a driver’s education course demonstrates a commitment to safe driving practices, which can positively influence your insurance rates.

Insurance companies utilize a complex system to assess the risk associated with each driver. Factors like age, driving history, vehicle type, and location are considered. They also evaluate the likelihood of accidents, injuries, and claims based on historical data.

This analysis helps them determine the appropriate premium for each policyholder. By demonstrating a commitment to safe driving through driver’s education, you can potentially reduce your risk profile, leading to lower insurance premiums.

How Driver’s Education Affects Insurance Premiums

Driver’s education courses typically cover essential topics like defensive driving techniques, traffic laws, and vehicle maintenance. By completing such a course, you acquire valuable knowledge and skills that contribute to safer driving habits. This, in turn, reduces your risk of accidents, making you a more attractive candidate for insurance companies.

Insurance companies recognize the positive impact of driver’s education and often offer discounts to policyholders who have completed a certified course. These discounts can vary depending on the insurer and the specific program you completed.

How Driver’s Education Impacts Insurance Rates

Driver’s education plays a significant role in influencing insurance rates, primarily by demonstrating responsible driving habits and reducing the risk of accidents. Insurance companies recognize the value of driver’s education and often offer discounts to individuals who have completed a certified course.

Impact of Driver’s Education on Insurance Rates

Driver’s education courses are designed to equip new drivers with essential knowledge and skills to navigate the roads safely and responsibly. These courses cover a wide range of topics, from traffic laws and defensive driving techniques to vehicle maintenance and emergency procedures.

By completing a driver’s education course, individuals demonstrate their commitment to becoming safe and responsible drivers. This commitment is highly valued by insurance companies, as it suggests a lower likelihood of accidents and claims.

Examples of Skills Learned in Driver’s Education

Driver’s education courses provide practical training and theoretical knowledge that contribute to safer driving practices. Here are some specific examples of skills learned in driver’s education that can significantly impact insurance rates:

- Defensive Driving Techniques:Driver’s education emphasizes the importance of anticipating potential hazards, maintaining a safe following distance, and being aware of surroundings. These techniques help drivers avoid accidents and reduce the risk of collisions.

- Traffic Laws and Regulations:Driver’s education courses provide comprehensive instruction on traffic laws and regulations, ensuring drivers understand the rules of the road and can operate their vehicles safely and legally.

- Vehicle Control and Handling:Driver’s education programs include practical driving exercises that teach students how to control their vehicles in various situations, such as emergency braking, lane changes, and cornering. These skills help drivers react appropriately in challenging scenarios and avoid accidents.

- Risk Assessment and Decision-Making:Driver’s education emphasizes the importance of assessing risks and making informed decisions on the road. Students learn to identify potential hazards, evaluate risks, and make safe choices while driving.

Insurance Company Perspective on Driver’s Education

Insurance companies view driver’s education as a positive factor in their risk assessment process. By completing a driver’s education course, individuals demonstrate their commitment to safe driving practices, which reduces the likelihood of accidents and claims. This, in turn, translates to lower insurance premiums for individuals who have completed driver’s education.Insurance companies often offer discounts to drivers who have completed a certified driver’s education course.

These discounts can vary depending on the insurer, the specific course completed, and the individual’s driving record. However, the general principle remains the same: driver’s education demonstrates a commitment to responsible driving, which translates to lower insurance premiums.

Discounts and Savings

Completing a driver’s education course can lead to significant savings on car insurance premiums. Insurance companies recognize that driver’s education equips new drivers with essential knowledge and skills, reducing the risk of accidents and claims. This translates into substantial financial benefits for policyholders.

Driver’s Education Discounts

Insurance companies offer various discounts for driver’s education completion. These discounts are designed to incentivize young drivers to acquire the necessary knowledge and skills to become safer drivers, ultimately lowering the risk of accidents and claims. The specific discounts offered and their percentage vary depending on the insurer, state, and the type of driver’s education course completed.

- Good Student Discount:Many insurance companies offer a discount for maintaining good academic standing. This discount is typically available to students who achieve a certain GPA or maintain a high class rank. This discount is often bundled with the driver’s education discount, further emphasizing the importance of education in safe driving.

- Defensive Driving Course Discount:Some insurers offer a discount for completing a defensive driving course, which teaches safe driving techniques and strategies to avoid accidents. These courses are often available online or in person and are generally recognized by most insurance companies.

- Driver’s Education Completion Discount:This is the most common discount offered by insurance companies for driver’s education completion. The discount is usually a percentage reduction in the premium, and it is often applied to the entire policy. This discount recognizes the value of driver’s education in equipping new drivers with essential knowledge and skills, reducing the risk of accidents and claims.

Examples of Insurance Company Discounts

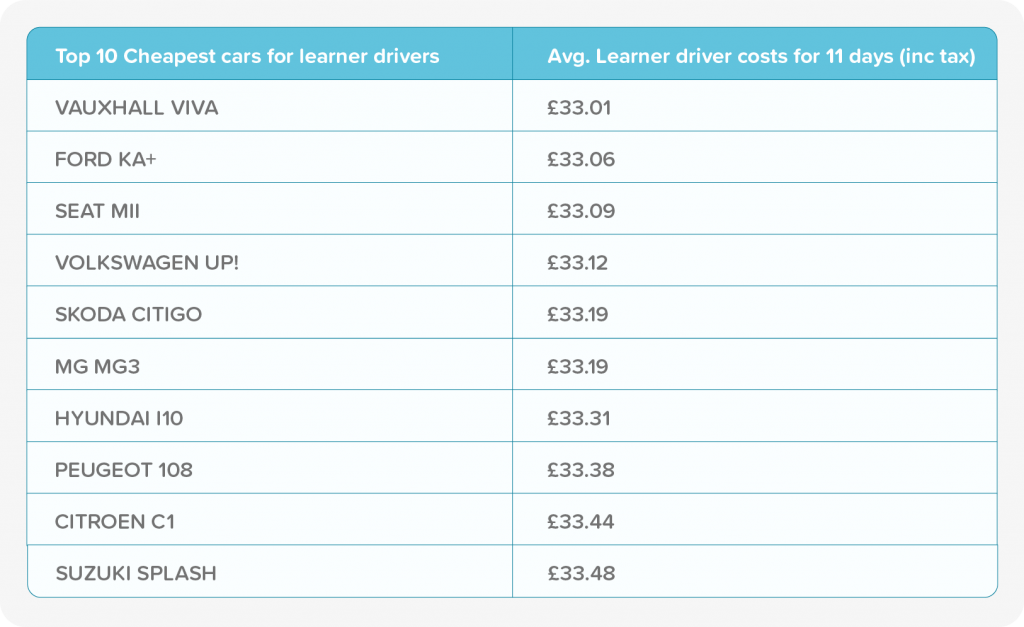

Here are some examples of insurance companies and their discounts for driver’s education:

| Insurance Company | Discount Type | Discount Percentage |

|---|---|---|

| State Farm | Driver’s Education Completion | 10% |

| Geico | Driver’s Education Completion | 5-15% |

| Progressive | Driver’s Education Completion | 5-10% |

| Allstate | Driver’s Education Completion | 5-15% |

Comparing Discount Percentages, How much does drivers ed save you on insurance

The discount percentages offered by different insurance companies can vary significantly. It’s essential to compare quotes from multiple insurers to find the best deal. For instance, State Farm offers a 10% discount for driver’s education completion, while Geico offers a discount ranging from 5% to 15%.

Progressive and Allstate offer similar discounts, ranging from 5% to 10% and 5% to 15%, respectively. It’s important to note that the discount percentage may be influenced by several factors, including the driver’s age, driving history, and the state of residence.

Therefore, it’s always advisable to contact the insurance company directly to confirm the specific discount offered for your situation.

Cost of Driver’s Education

The cost of driver’s education can vary significantly depending on several factors. Understanding these costs is crucial for individuals and families planning to enroll in a driver’s education program. It’s essential to consider the cost of driver’s education in relation to the potential savings on car insurance premiums, as this can help make an informed decision about whether driver’s education is a worthwhile investment.

Factors Influencing the Cost of Driver’s Education

The cost of driver’s education can be influenced by several factors, including:

- Location:The cost of living and competition among driver’s education providers can impact pricing. For example, urban areas with a high demand for driver’s education may have higher costs than rural areas.

- Program Length:Driver’s education programs can vary in length, with some programs offering more classroom instruction and behind-the-wheel training than others. Longer programs typically have a higher cost.

- Program Type:The type of driver’s education program can also influence the cost. For example, private driver’s education programs may have higher fees than those offered by public schools or community organizations.

- Additional Services:Some driver’s education programs offer additional services, such as driving simulators or online learning modules, which can increase the overall cost.

Comparing the Cost of Driver’s Education with Potential Savings on Insurance Premiums

The cost of driver’s education is generally outweighed by the potential savings on car insurance premiums. Many insurance companies offer discounts to drivers who have completed a driver’s education program. These discounts can vary depending on the insurer and the specific program completed.

For example:A driver’s education program that costs $500 could potentially save a driver $500 or more on their car insurance premiums over a few years.

It’s essential to research the discounts offered by different insurance companies before enrolling in a driver’s education program. Some insurers may require proof of completion of a specific program or may have certain eligibility requirements.

Other Factors Affecting Insurance Rates

While driver’s education can significantly impact your car insurance premiums, it’s just one piece of the puzzle. Several other factors contribute to how much you pay for insurance, and understanding them can help you make informed decisions.

Age

Your age plays a significant role in determining your insurance rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents due to factors like inexperience, risk-taking behavior, and lack of driving history. As you gain experience and age, your rates generally decrease.

Driving History

Your driving history, including accidents, traffic violations, and even parking tickets, significantly influences your insurance premiums. A clean driving record earns you lower rates, while accidents or violations can lead to higher premiums. Some insurance companies may even offer discounts for drivers who complete defensive driving courses or maintain a safe driving record.

Vehicle Type

The type of vehicle you drive also plays a significant role in your insurance rates. High-performance cars, luxury vehicles, and vehicles with expensive parts or repair costs tend to have higher insurance premiums. This is because these vehicles are generally more expensive to repair or replace in case of an accident.

Location

The location where you live impacts your insurance rates. Areas with higher crime rates, traffic congestion, and accident frequencies tend to have higher insurance premiums. Insurance companies consider these factors because they increase the likelihood of accidents and potential claims.

Credit Score

In some states, your credit score can be a factor in determining your insurance rates. This practice is controversial, with some arguing that it’s unfair to use credit history to assess driving risk. However, insurance companies often use credit score as a proxy for financial responsibility, believing that individuals with good credit are more likely to pay their insurance premiums on time.

Other Factors

Besides these primary factors, other elements can influence your insurance rates. These include:

- Marital Status: In some cases, married individuals may receive lower rates due to perceived increased responsibility and stability.

- Gender: While gender-based pricing is becoming increasingly restricted, it’s still a factor in some regions.

- Occupation: Certain occupations may require frequent driving or involve higher risks, leading to higher insurance premiums.

- Number of Vehicles: Insuring multiple vehicles with the same company can sometimes lead to discounts.

Tips for Saving on Car Insurance

As a young driver, securing affordable car insurance is essential. By understanding the factors that influence insurance rates and adopting smart strategies, you can significantly reduce your premiums.

Maintaining a Good Driving Record

A clean driving record is a cornerstone of affordable car insurance. Insurance companies reward drivers with no accidents or traffic violations with lower premiums.

- Avoid Traffic Violations:Speeding, reckless driving, and other traffic offenses can lead to higher insurance rates and even license suspension. Always follow traffic laws and drive responsibly.

- Take Defensive Driving Courses:Defensive driving courses teach you safe driving techniques and can earn you discounts on your insurance. These courses are often offered online or through local driving schools.

- Maintain a Safe Driving Record:Stay vigilant while driving, avoid distractions, and prioritize safety. A clean driving record demonstrates your commitment to responsible driving, leading to lower insurance costs.

Comparing Quotes from Multiple Insurance Providers

Shopping around for insurance is crucial to finding the best rates. Different insurance companies have varying pricing structures, so comparing quotes from multiple providers can save you money.

- Use Online Comparison Tools:Several websites allow you to enter your information and receive quotes from multiple insurers simultaneously. This simplifies the comparison process and saves you time.

- Contact Insurance Agents Directly:Reach out to insurance agents in your area and request quotes. They can provide personalized recommendations and explain different policy options.

- Negotiate Rates:Once you’ve received quotes, don’t hesitate to negotiate. Explain your good driving record, any safety features in your car, and your willingness to explore different coverage options. You might be able to secure a better rate through negotiation.

Detailed FAQs: How Much Does Drivers Ed Save You On Insurance

Is driver’s education mandatory in all states?

No, driver’s education is not mandatory in all states. Some states require it for young drivers, while others only recommend it. Check your state’s specific requirements.

What are the typical requirements for driver’s education programs?

Typical requirements include classroom instruction, behind-the-wheel training, and a driving test. Specific requirements may vary by state and program.

Can I get a driver’s education discount even if I haven’t taken a formal course?

Some insurance companies may offer discounts for completing a driver’s education course, but they may also offer discounts for other programs like defensive driving courses or online safety courses.

How long does a driver’s education discount last?

The duration of a driver’s education discount varies by insurance company. Some may offer it for a limited period, while others may extend it for the duration of your policy.