Insurance Claim Certificate of Completion

An insurance claim certificate of completion, also known as a “claim completion certificate,” is a formal document issued by an insurance company to the policyholder after an insurance claim has been settled. It confirms that the claim has been processed, the agreed-upon compensation has been paid, and all relevant obligations have been fulfilled by both parties.This certificate serves as a crucial document in the insurance claims process, playing a vital role in ensuring transparency, accountability, and closure.

It provides a record of the claim settlement, confirming that the insurer has fulfilled its contractual obligations to the policyholder.

Purpose of an Insurance Claim Certificate of Completion

The primary purpose of an insurance claim certificate of completion is to formally document the successful resolution of an insurance claim. This certificate serves as evidence that:

- The claim has been thoroughly investigated and assessed by the insurer.

- The policyholder has received the agreed-upon compensation for the covered loss.

- All relevant documentation and communication related to the claim have been properly recorded.

- Both the insurer and the policyholder have fulfilled their respective obligations under the insurance policy.

This certificate is essential for establishing a clear and definitive record of the claim settlement, preventing future disputes or misunderstandings between the insurer and the policyholder.

Situations Requiring an Insurance Claim Certificate of Completion

An insurance claim certificate of completion is typically required in various situations, including:

- Property Insurance Claims:After the completion of repairs or replacement of damaged property, the insurer issues this certificate to confirm that the claim has been settled and the policyholder has received the necessary compensation.

- Health Insurance Claims:When a health insurance claim for medical expenses is settled, the insurer issues a certificate to confirm that the claim has been processed and the policyholder has received the appropriate reimbursement.

- Life Insurance Claims:In the event of a death claim, the insurer issues a certificate of completion to confirm that the beneficiary has received the death benefit payment.

- Disability Insurance Claims:When a disability insurance claim is settled, the insurer issues a certificate to confirm that the policyholder has received the agreed-upon benefits.

Content of an Insurance Claim Certificate of Completion

A certificate of completion (COC) is a crucial document in the insurance claims process, confirming that the insured party has fulfilled all necessary requirements and actions related to their claim. It signifies that the claim has been settled, and the insurer is no longer obligated to pay for any further expenses.

This document provides a formal record of the claim’s closure, outlining the completed tasks, repairs, or services, and verifying that the insured has complied with the insurer’s requirements.

Essential Information, Insurance claim certificate of completion

The content of an insurance claim certificate of completion typically includes the following essential information:

- Claim Number:A unique identifier assigned to the claim, allowing for easy tracking and referencing.

- Policyholder Information:The name, address, and policy number of the insured individual or entity.

- Date of Loss:The date when the insured event occurred, initiating the claim.

- Description of Loss:A concise but comprehensive description of the event that led to the insurance claim, including details about the damage or injury sustained.

- Details of Repairs or Services:A clear and detailed account of the repairs, replacements, or services performed to address the damage or injury, including specific materials, parts, and labor costs.

- Settlement Amount:The final amount paid by the insurer to settle the claim, covering the costs of repairs, replacements, or other expenses related to the loss.

- Date of Completion:The date on which the claim was considered fully settled and closed.

- Signatures:Signatures of both the insured and the insurer’s representative, confirming the completion of the claim and their agreement on the settlement terms.

Importance of Accuracy and Completeness

The accuracy and completeness of the information provided in the certificate of completion are crucial for several reasons:

- Legal Documentation:The COC serves as a legal document, confirming the settlement of the claim and the insurer’s fulfillment of their obligations. Inaccurate or incomplete information can lead to legal disputes or challenges in the future.

- Financial Records:The certificate provides a clear and verifiable record of the claim’s settlement amount, enabling both the insured and the insurer to maintain accurate financial records and avoid discrepancies or misunderstandings.

- Future Claims:In the event of future claims, the COC can serve as a reference point for both the insured and the insurer, highlighting the history of previous claims and any relevant information that may be useful in assessing new claims.

- Fraud Prevention:Accurate and complete information in the COC helps to deter fraud and ensure that all claims are handled fairly and transparently. It also provides a record of the claim’s resolution, making it difficult for individuals to make false claims or manipulate the system.

Legal and Regulatory Requirements

The content of an insurance claim certificate of completion may be subject to specific legal and regulatory requirements depending on the jurisdiction and type of insurance involved.

For example, some states may have specific regulations regarding the information that must be included in the certificate, or the format in which it must be presented.

It is essential for insurers to consult with legal counsel and ensure that their COCs comply with all applicable laws and regulations.

Issuing an Insurance Claim Certificate of Completion

An insurance claim certificate of completion is a crucial document that formally declares the completion of repairs or services related to an insurance claim. This certificate serves as official confirmation that the insured party has fulfilled the necessary requirements to finalize the claim and receive any remaining benefits.

Issuing the Certificate of Completion

The process of issuing an insurance claim certificate of completion typically involves a collaborative effort between the insured party, the insurer, and the service provider or contractor who performed the repairs or services. This process ensures transparency and accountability throughout the claim settlement process.

- Role of the Insured Party: The insured party plays a vital role in initiating the issuance process. They must first notify the insurer about the completion of repairs or services. This notification can be done through a formal letter, email, or phone call, depending on the insurer’s preferred communication channels.

The insured party must also provide supporting documentation, such as invoices, receipts, and photographs, to verify the completed work.

- Role of the Insurer: The insurer is responsible for verifying the completion of repairs or services. They may require an independent inspection of the work to ensure it meets the standards Artikeld in the insurance policy. The insurer will also review all supporting documentation provided by the insured party to confirm the accuracy of the claim.

- Role of the Service Provider: The service provider or contractor plays a key role in providing evidence of the completed work. They must provide detailed invoices, receipts, and a comprehensive report outlining the scope of the repairs or services performed. They may also be required to provide warranties or guarantees for the work.

Verifying the Completion of Repairs or Services

Once the insured party has notified the insurer about the completion of repairs or services, the insurer initiates the verification process. This process typically involves a thorough review of the supporting documentation and, in some cases, an independent inspection of the work.

- Document Review: The insurer will carefully examine all supporting documentation provided by the insured party, including invoices, receipts, and photographs. This review ensures that the work performed aligns with the scope of the insurance claim and that the costs incurred are reasonable and justified.

- Independent Inspection: In some cases, the insurer may require an independent inspection of the work to ensure it meets the standards Artikeld in the insurance policy. This inspection is typically conducted by a qualified professional, such as a building inspector or an engineer.

The inspector will assess the quality of the work, the materials used, and the overall completion of the repairs or services.

Documentation Supporting the Certificate of Completion

Adequate documentation is crucial in supporting the issuance of an insurance claim certificate of completion. This documentation serves as evidence of the completed work and helps to ensure a smooth and efficient claim settlement process.

- Invoices and Receipts: Detailed invoices and receipts for all repairs or services performed are essential. These documents should clearly Artikel the work completed, the materials used, and the total cost incurred.

- Photographs: Before and after photographs of the damaged property and the completed repairs or services can provide valuable visual evidence of the work performed.

- Service Provider Reports: A comprehensive report from the service provider or contractor outlining the scope of the work performed is highly recommended. This report should include details about the materials used, the methods employed, and any challenges encountered during the repairs or services.

- Warranties and Guarantees: Warranties or guarantees provided by the service provider for the completed work can offer additional assurance to the insured party and the insurer. These documents demonstrate the service provider’s confidence in the quality of the work performed.

Importance of the Insurance Claim Certificate of Completion

The Insurance Claim Certificate of Completion is a crucial document that serves as a formal record of the successful completion of an insurance claim. It signifies the insurer’s acknowledgment of the insured’s claim and the completion of the agreed-upon repairs or compensation.

This certificate is essential for ensuring the smooth and timely resolution of insurance claims.

Significance in Claim Resolution

The Insurance Claim Certificate of Completion plays a pivotal role in ensuring the successful resolution of claims. It provides a clear and concise record of the claim’s completion, including the nature of the damage, the scope of repairs, and the amount of compensation paid.

This documentation helps to prevent future disputes or disagreements between the insured and the insurer.

Preventing Disputes and Delays

The certificate serves as a formal acknowledgment of the claim’s completion, which can help prevent disputes or delays in the claims process. For example, if the insured later claims that they did not receive full compensation or that certain repairs were not completed, the certificate provides a clear and verifiable record of the agreed-upon terms.

Consequences of Incomplete or Inaccurate Certificates

Failure to provide a complete and accurate Insurance Claim Certificate of Completion can lead to several consequences:

- Disputes and Delays:An incomplete or inaccurate certificate can create confusion and ambiguity, leading to disputes and delays in the claims process. The insured may find it difficult to prove that the claim was fully settled, while the insurer may face challenges in verifying the accuracy of the information provided.

- Legal Challenges:In the event of a legal dispute, the absence of a complete and accurate certificate can weaken the insured’s position. It may be difficult to prove the extent of the damage or the amount of compensation received without proper documentation.

- Financial Implications:An incomplete or inaccurate certificate may result in financial implications for both the insured and the insurer. The insured may face difficulties in recovering full compensation, while the insurer may face financial losses due to unresolved claims.

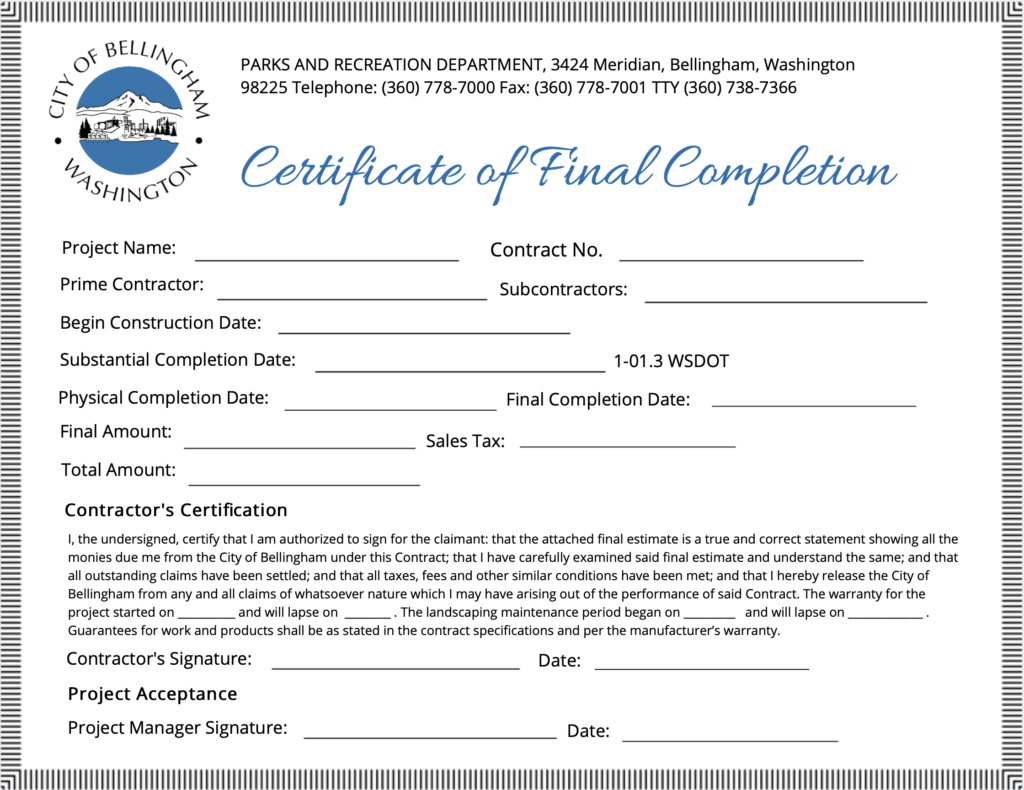

Examples of Insurance Claim Certificates of Completion

An Insurance Claim Certificate of Completion is a formal document that serves as proof that the insured party has fulfilled all necessary requirements for the insurance claim to be considered complete. It is a vital document for both the insured and the insurer.

It serves as a record of the completed claim, outlining the scope of the work, the cost incurred, and the date of completion.

Examples of Insurance Claim Certificates of Completion

The following are real-world examples of certificates of completion from different insurance scenarios:

| Scenario | Certificate Content | Importance |

|---|---|---|

| Home Repair | A certificate of completion for home repairs would include details such as the address of the property, the date of the damage, the nature of the damage, the repairs completed, the cost of the repairs, and the date of completion. It would also include the names of the insured and the contractor who performed the repairs. | This certificate serves as proof that the repairs have been completed according to the agreed-upon terms and conditions of the insurance policy. It also serves as a record of the cost of the repairs, which is important for both the insured and the insurer. |

| Vehicle Repair | A certificate of completion for vehicle repairs would include details such as the vehicle identification number (VIN), the date of the accident, the nature of the damage, the repairs completed, the cost of the repairs, and the date of completion. It would also include the names of the insured and the repair shop that performed the repairs. | This certificate serves as proof that the vehicle has been repaired to the agreed-upon standards and is safe to drive. It also serves as a record of the cost of the repairs, which is important for both the insured and the insurer. |

| Medical Treatment | A certificate of completion for medical treatment would include details such as the name of the insured, the date of the accident or illness, the nature of the injury or illness, the medical treatment received, the cost of the treatment, and the date of completion. It would also include the name of the healthcare provider who provided the treatment. | This certificate serves as proof that the medical treatment has been completed and that the insured has fulfilled all necessary requirements for the claim. It also serves as a record of the cost of the treatment, which is important for both the insured and the insurer. |

Sample Certificate of Completion for a Home Repair Claim

Insurance Claim Certificate of CompletionPolicy Number:[Policy Number] Claim Number:[Claim Number] Insured:[Insured Name] Address:[Insured Address] Date of Damage:[Date of Damage] Nature of Damage:[Nature of Damage] Contractor:[Contractor Name] Contractor Address:[Contractor Address] Repairs Completed:[List of Repairs] Cost of Repairs:[Cost of Repairs] Date of Completion:[Date of Completion] This certificate confirms that the repairs listed above have been completed to the satisfaction of the insured and the insurer.Signature of Insured:_________________________________ Date:_________________________________ Signature of Contractor:_________________________________ Date:_________________________________

Commonly Asked Questions

Who typically issues an insurance claim certificate of completion?

The party responsible for completing the repairs or services related to the insurance claim, such as a contractor, repair shop, or healthcare provider, typically issues the certificate of completion.

What happens if the certificate of completion is incomplete or inaccurate?

An incomplete or inaccurate certificate can lead to delays in the claims process, disputes between the insured party and the insurance company, and potential denial of the claim.

Is a certificate of completion always required for an insurance claim?

While not always explicitly required, a certificate of completion is generally considered good practice and can significantly streamline the claims process, particularly for larger or complex claims.