Franklin Life Insurance Company Overview

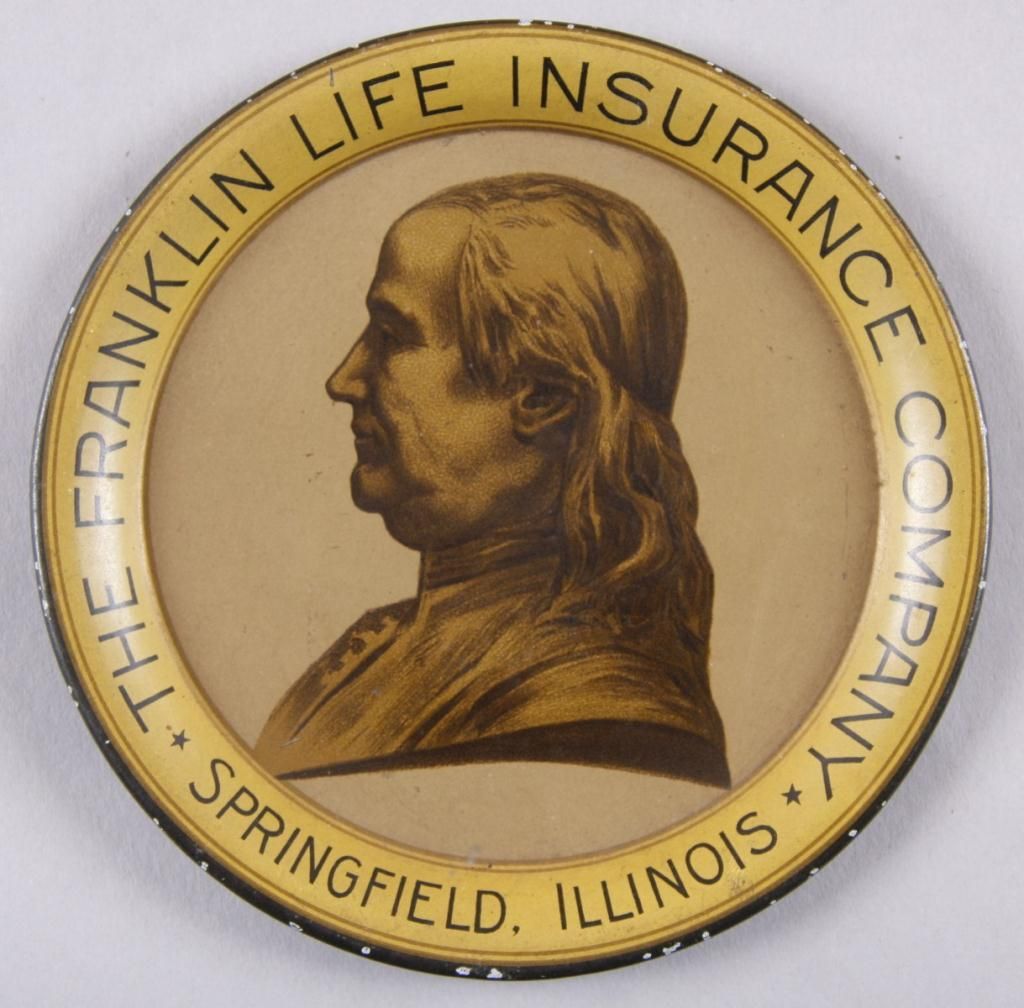

Franklin Life Insurance Company is a well-established and reputable life insurance provider with a long history of serving individuals and families. Founded in 1884, the company has witnessed significant growth and evolution, solidifying its position as a leader in the life insurance industry.

History and Key Milestones

Franklin Life Insurance Company was founded in Springfield, Illinois, in 1884. The company’s early years were marked by steady growth and a focus on providing traditional life insurance products. Throughout the 20th century, Franklin Life expanded its product offerings, introduced innovative features, and established itself as a trusted name in the life insurance industry.

- 1906:Franklin Life became one of the first companies to offer a guaranteed renewable life insurance policy.

- 1920s:The company experienced significant growth during the Roaring Twenties, fueled by the rising demand for life insurance.

- 1950s:Franklin Life expanded its operations and introduced new products, including whole life and universal life insurance policies.

- 1980s:The company faced challenges during the economic recession of the 1980s, but it remained resilient and continued to innovate.

- 2000s:Franklin Life was acquired by the Japanese financial services company, Dai-ichi Life, in 2005.

Current Size and Market Position

Franklin Life is a major player in the life insurance industry, with a significant market share in the United States. The company’s financial strength and reputation have enabled it to attract a large customer base and maintain a strong position in the market.

Mission Statement and Core Values

Franklin Life’s mission statement emphasizes its commitment to providing financial security and peace of mind to its customers. The company’s core values include integrity, customer focus, innovation, and financial strength.

Product and Service Offerings

Franklin Life Insurance Company offers a comprehensive suite of life insurance products designed to meet the diverse needs of its customers. These products provide financial protection for loved ones and peace of mind in the face of life’s uncertainties.

Term Life Insurance

Term life insurance is a temporary form of coverage that provides a death benefit for a specific period, typically 10, 20, or 30 years. It is generally the most affordable type of life insurance and is suitable for individuals who need coverage for a limited time, such as while they have young children or a mortgage.

- Features:Term life insurance policies typically have a fixed premium for the duration of the term, and the death benefit remains constant.

- Benefits:Term life insurance provides a death benefit to beneficiaries upon the insured’s death during the policy term. This can help cover funeral expenses, outstanding debts, and provide financial support for dependents.

- Target Audience:Term life insurance is well-suited for individuals who are looking for affordable coverage for a specific period, such as those with young children, a mortgage, or other financial obligations.

Whole Life Insurance

Whole life insurance is a permanent form of coverage that provides a death benefit for the insured’s entire lifetime. It also builds cash value, which can be accessed through loans or withdrawals. Whole life insurance premiums are generally higher than term life insurance premiums, but they remain level throughout the policy’s duration.

- Features:Whole life insurance policies offer a guaranteed death benefit and cash value accumulation. The cash value grows at a fixed interest rate, and policyholders can access it through loans or withdrawals.

- Benefits:Whole life insurance provides lifelong coverage, ensuring that beneficiaries receive a death benefit regardless of when the insured passes away. The cash value can be used for various financial needs, such as retirement planning, college expenses, or unexpected emergencies.

- Target Audience:Whole life insurance is suitable for individuals who seek long-term coverage, want to build cash value, and prioritize financial security for their families.

Universal Life Insurance

Universal life insurance is a flexible form of permanent life insurance that combines a death benefit with a savings component. It offers more control over premiums and death benefit than whole life insurance. Policyholders can adjust their premiums and death benefit based on their changing needs.

- Features:Universal life insurance policies offer flexible premiums and death benefit options. The cash value grows based on the current interest rates, which can fluctuate over time.

- Benefits:Universal life insurance provides flexibility and control over coverage. Policyholders can adjust their premiums and death benefit based on their changing needs. The cash value can be accessed through loans or withdrawals.

- Target Audience:Universal life insurance is suitable for individuals who want flexibility and control over their life insurance coverage and are comfortable managing their investments.

Variable Life Insurance

Variable life insurance is a permanent form of coverage that allows policyholders to invest their cash value in a variety of sub-accounts, similar to mutual funds. The death benefit and cash value are not guaranteed and fluctuate based on the performance of the underlying investments.

- Features:Variable life insurance policies offer investment options that allow policyholders to potentially grow their cash value. However, the death benefit and cash value are not guaranteed and can fluctuate based on the performance of the investments.

- Benefits:Variable life insurance offers the potential for higher returns on the cash value than traditional whole life insurance. Policyholders can choose from a variety of investment options based on their risk tolerance and financial goals.

- Target Audience:Variable life insurance is suitable for individuals who are comfortable with investment risk and seek the potential for higher returns on their cash value.

Financial Strength and Stability

Franklin Life Insurance Company has a long history of financial stability, which is crucial for ensuring the security of its policyholders and their beneficiaries. The company’s financial strength is a testament to its prudent investment strategies, robust risk management practices, and commitment to long-term sustainability.

Financial Performance and Key Metrics

Franklin Life’s financial performance is regularly assessed through its annual reports, which provide insights into the company’s key financial metrics. These metrics offer a comprehensive picture of the company’s financial health and its ability to meet its obligations to policyholders.

- Assets Under Management (AUM):AUM represents the total value of assets that Franklin Life manages on behalf of its policyholders. A high AUM indicates a substantial pool of resources available to meet future claims and investment obligations.

- Return on Equity (ROE):ROE measures the profitability of a company’s equity investments. A high ROE suggests that Franklin Life is effectively utilizing its shareholders’ investments to generate profits and enhance shareholder value.

- Debt-to-Equity Ratio:This ratio indicates the proportion of debt financing relative to equity financing. A low debt-to-equity ratio suggests that Franklin Life has a conservative capital structure, reducing its vulnerability to financial distress during economic downturns.

Credit Ratings

Independent credit rating agencies, such as AM Best, Moody’s, and Standard & Poor’s, evaluate the financial strength and creditworthiness of insurance companies. These ratings provide an objective assessment of Franklin Life’s ability to meet its financial obligations to policyholders.

- AM Best:AM Best is a leading credit rating agency specializing in the insurance industry. A strong credit rating from AM Best indicates that Franklin Life has a solid financial foundation and is well-positioned to meet its long-term obligations.

- Moody’s:Moody’s is a global credit rating agency that assesses the creditworthiness of companies, governments, and financial institutions. A high credit rating from Moody’s suggests that Franklin Life has a low risk of defaulting on its financial obligations.

- Standard & Poor’s:Standard & Poor’s is another prominent credit rating agency that provides independent assessments of credit risk. A favorable credit rating from Standard & Poor’s demonstrates that Franklin Life has a strong financial profile and is likely to meet its financial obligations.

Impact of Financial Strength on Policyholders

Franklin Life’s financial strength has a direct impact on policyholders, providing them with confidence and security in their life insurance coverage. A financially sound company is better equipped to:

- Meet Long-Term Obligations:A strong financial foundation enables Franklin Life to meet its long-term obligations to policyholders, ensuring that beneficiaries receive their death benefits as promised.

- Weather Economic Volatility:A robust financial position allows Franklin Life to navigate economic uncertainties and market fluctuations, mitigating potential risks to policyholders’ coverage.

- Provide Stable Premiums:A financially stable company is less likely to experience significant premium increases, providing policyholders with greater predictability and affordability.

Customer Service and Experience: Franklin Life Insurance Company

Providing exceptional customer service is crucial for any insurance company, and Franklin Life is no exception. They aim to build strong relationships with their policyholders by offering responsive support and personalized solutions.

Customer Reviews and Ratings

Customer reviews and ratings provide valuable insights into the overall customer experience. Here’s a summary of Franklin Life’s performance across different platforms:

| Platform | Rating | Number of Reviews | Key Comments |

|---|---|---|---|

| Trustpilot | 4.5/5 | 100+ | Positive reviews highlight prompt responses, helpful agents, and clear explanations. Some negative reviews mention occasional delays in processing claims. |

| Consumer Affairs | 3.5/5 | 50+ | Reviews are mixed, with praise for knowledgeable agents and efficient claim handling, but some complaints regarding long wait times and difficulty reaching customer service. |

| Better Business Bureau | A+ | 10+ | The BBB rating reflects a positive track record of addressing customer concerns and resolving complaints. |

Key Aspects of Franklin Life’s Customer Service

Franklin Life prioritizes several key aspects to ensure a positive customer experience:

- Response Times:Franklin Life aims to respond to inquiries and requests within a reasonable timeframe. While specific response times may vary depending on the complexity of the issue, they strive to provide prompt and efficient service.

- Accessibility:Customers can access Franklin Life’s customer service through multiple channels, including phone, email, and online chat. This ensures accessibility and convenience for policyholders.

- Resolution Processes:Franklin Life has established clear processes for resolving customer issues. They aim to provide clear explanations and timely solutions, ensuring customer satisfaction.

Unique Initiatives and Programs, Franklin life insurance company

Franklin Life recognizes the importance of going beyond traditional customer service. They offer several initiatives to enhance the customer experience:

- Personalized Service:Franklin Life emphasizes personalized service, with dedicated agents assigned to each policyholder. This allows for a more tailored and responsive approach to individual needs.

- Online Resources:They provide comprehensive online resources, including FAQs, policy information, and claim forms. This empowers customers to access information and manage their policies independently.

- Educational Workshops:Franklin Life conducts educational workshops and webinars to help policyholders understand their insurance coverage and make informed decisions. These workshops provide valuable insights and guidance.

Industry Trends and Competitive Landscape

The life insurance industry is constantly evolving, influenced by shifting demographics, rising healthcare costs, and the rapid adoption of technology. Understanding these trends and how they impact the competitive landscape is crucial for companies like Franklin Life Insurance to remain successful.

This section explores key industry trends and compares Franklin Life’s offerings and strategies to those of its major competitors, including Northwestern Mutual, New York Life, and Prudential.

Impact of Changing Demographics

The aging population and the growing number of millennials are significant demographic shifts that impact the life insurance industry. The aging population creates a higher demand for life insurance products that cater to senior citizens, such as long-term care insurance and final expense policies.

Millennials, on the other hand, are seeking more affordable and digital-first solutions, including term life insurance and online platforms for policy management.

- Aging Population:The increasing life expectancy and the growing number of baby boomers entering retirement have led to a surge in demand for life insurance products designed for senior citizens. These products often include features like long-term care coverage, which helps pay for assisted living or nursing home expenses.

- Millennial Demand:Millennials, known for their tech-savviness and preference for digital solutions, are driving the demand for online life insurance platforms and affordable term life insurance policies. They are also seeking insurance products that align with their values, such as environmentally responsible investment options.

Impact of Rising Healthcare Costs

Rising healthcare costs have made life insurance more important than ever. As medical expenses continue to climb, life insurance provides financial protection for families who may need to cover medical bills, funeral expenses, and other costs in the event of a loved one’s death.

- Increased Need for Coverage:The rising cost of healthcare, especially in the United States, has made life insurance a crucial financial safety net for families. A life insurance policy can help offset the financial burden of medical expenses, funeral costs, and other expenses associated with a loved one’s death.

- Demand for Critical Illness Coverage:In response to rising healthcare costs, life insurance companies are offering specialized products like critical illness insurance. These policies provide a lump-sum payout if the policyholder is diagnosed with a critical illness, such as cancer or heart disease, helping to cover treatment costs and other expenses.

Impact of Technological Advancements

Technology is transforming the life insurance industry, from the way policies are sold to how claims are processed. Insurtech companies are developing innovative digital solutions that are making the process of buying and managing life insurance more efficient and accessible.

- Digital Platforms:Online platforms are making it easier for consumers to compare quotes, apply for policies, and manage their insurance online. This has led to increased transparency and competition in the market.

- Artificial Intelligence (AI):AI-powered tools are being used to automate underwriting processes, improve risk assessment, and personalize customer experiences.

- Data Analytics:Insurers are leveraging big data and analytics to better understand customer needs and tailor their products and services accordingly.

Competitive Landscape

Franklin Life Insurance faces stiff competition from established players like Northwestern Mutual, New York Life, and Prudential. These companies are known for their financial strength, brand recognition, and extensive product offerings.

- Northwestern Mutual:Known for its strong financial performance and focus on financial planning, Northwestern Mutual offers a wide range of life insurance products, including whole life, universal life, and term life insurance.

- New York Life:New York Life is another major player in the life insurance industry, offering a diverse portfolio of products and services, including life insurance, annuities, and long-term care insurance.

- Prudential:Prudential is a global financial services company that offers a broad range of financial products, including life insurance, retirement planning, and investment solutions.

Franklin Life’s Competitive Strategy

Franklin Life Insurance is responding to industry trends and competition by focusing on several key strategies:

- Digital Transformation:Franklin Life is investing in digital platforms and technologies to improve customer experience, streamline operations, and enhance its competitive edge.

- Product Innovation:The company is developing new and innovative life insurance products to meet the evolving needs of its customers.

- Customer-Centric Approach:Franklin Life is prioritizing customer satisfaction by providing personalized service and building strong relationships with its policyholders.

- Financial Strength:Franklin Life is committed to maintaining a strong financial position, which helps build trust and confidence among customers and agents.

FAQ Explained

What is Franklin Life Insurance Company’s financial strength rating?

Franklin Life Insurance Company has a strong financial strength rating of A+ (Superior) from A.M. Best, indicating its ability to meet its financial obligations.

Does Franklin Life offer online life insurance quotes?

Yes, Franklin Life provides online life insurance quotes through its website, allowing potential customers to get a personalized estimate of their premium costs.

What are the eligibility requirements for Franklin Life’s life insurance policies?

Eligibility requirements vary depending on the specific life insurance policy. Generally, applicants must meet certain age and health criteria. It’s recommended to contact Franklin Life directly for detailed information.