Fire and Extended Coverage Insurance

Fire and extended coverage insurance are essential components of property insurance policies, providing financial protection against various risks that could damage or destroy your property. Understanding the nuances of these coverages is crucial for ensuring adequate protection for your assets.

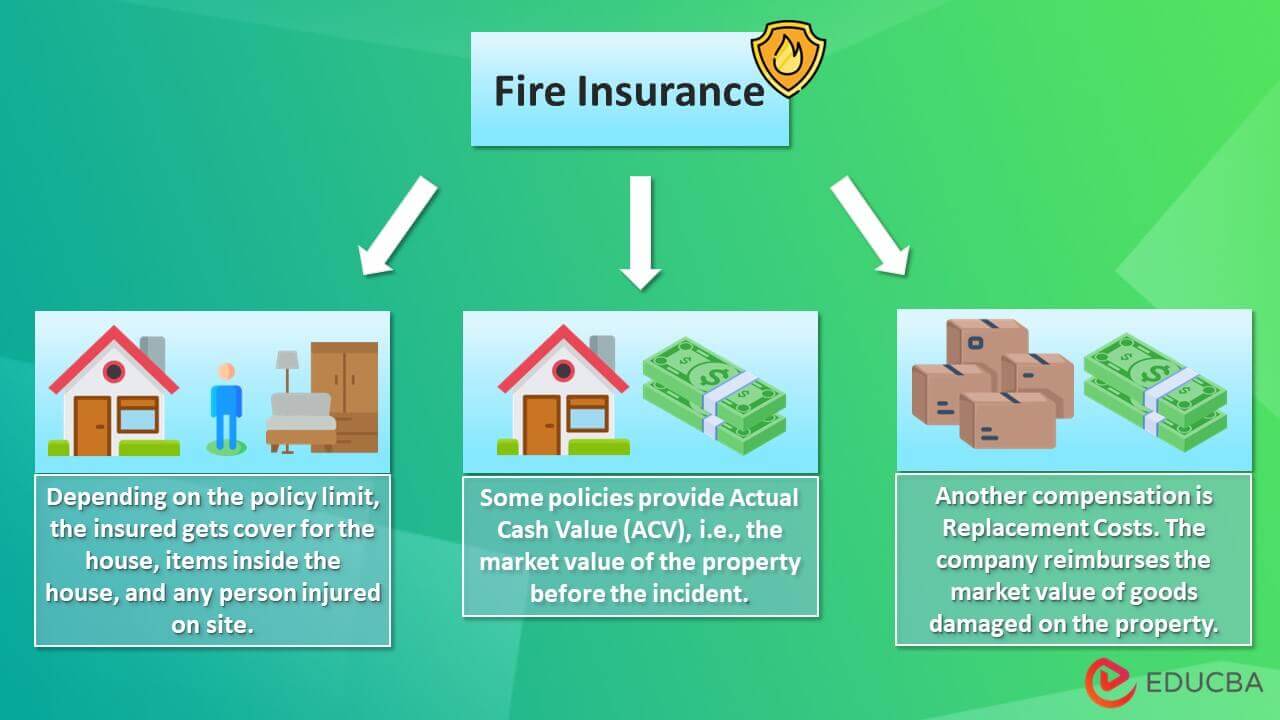

Fire Insurance

Fire insurance is a type of property insurance that covers losses resulting from fire or related events, such as smoke damage, water damage from firefighting efforts, and the cost of removing debris. The primary purpose of fire insurance is to safeguard your property against the financial consequences of fire-related incidents.

Extended Coverage Insurance

Extended coverage insurance expands upon the protection offered by standard fire insurance policies, providing coverage for a wider range of perils. Common perils included in extended coverage insurance policies include:

- Windstorm and Hail:Covers damage caused by strong winds, tornadoes, or hailstorms.

- Explosion:Protects against damage resulting from explosions, including those caused by gas leaks or faulty equipment.

- Riot and Civil Commotion:Provides coverage for damage caused by riots, civil unrest, or public disturbances.

- Aircraft Damage:Covers damage caused by aircraft or objects falling from aircraft.

- Vehicles:Protects against damage caused by vehicles colliding with your property.

- Smoke Damage:Covers damage caused by smoke, soot, or fumes, even if the fire is not directly caused by a fire.

- Vandalism and Malicious Mischief:Provides coverage for damage caused by vandalism or intentional acts of destruction.

- Sprinkler Leakage:Covers damage resulting from leaks in sprinkler systems.

- Falling Objects:Protects against damage caused by objects falling from a height, such as trees or debris.

Comparison of Fire and Extended Coverage Insurance

While fire insurance provides basic protection against fire-related risks, extended coverage insurance expands the scope of coverage to include additional perils. Here’s a table summarizing the key differences:

| Feature | Fire Insurance | Extended Coverage Insurance |

|---|---|---|

| Coverage | Fire and related events (smoke, water damage, debris removal) | Fire and other perils, including windstorm, hail, explosion, riot, aircraft damage, vehicles, smoke damage, vandalism, sprinkler leakage, and falling objects |

| Scope | Limited to fire-related risks | Broader coverage for various perils |

| Premium | Generally lower premiums | Higher premiums due to broader coverage |

Coverage Limits and Deductibles

Coverage limits and deductibles for fire and extended coverage policies vary depending on factors such as the location, type of property, and the insurer’s policies.

- Coverage Limits:The maximum amount the insurer will pay for a covered loss. This limit is typically expressed as a dollar amount or a percentage of the property’s value.

- Deductibles:The amount you are responsible for paying out-of-pocket before the insurer begins to cover the loss. Deductibles are typically fixed amounts, such as $500 or $1,000.

Example:A homeowner’s insurance policy may have a coverage limit of $250,000 for fire and extended coverage and a deductible of $1,000. If a fire causes $20,000 in damage to the home, the homeowner would be responsible for paying the first $1,000 of the loss, and the insurer would cover the remaining $19,000.

Covered Perils and Exclusions

Fire and extended coverage insurance policies are designed to protect homeowners from financial losses caused by a variety of perils. Understanding the covered perils and exclusions is crucial for policyholders to make informed decisions and ensure they have adequate protection.

Covered Perils

Covered perils are the events or circumstances that are insured against under a fire and extended coverage insurance policy. These perils are typically defined in the policy’s language. Here are some common perils covered:

- Fire:This is the primary peril covered by the policy. It includes damage caused by fire, smoke, and water used to extinguish the fire.

- Lightning:Damage caused by lightning strikes, including electrical surges and fires ignited by lightning.

- Windstorm:Damage caused by strong winds, including damage to roofs, walls, and windows.

- Hail:Damage caused by hail, such as broken windows and dents in roofs and vehicles.

- Explosion:Damage caused by explosions, including those from gas leaks, faulty appliances, or other sources.

- Riot or Civil Commotion:Damage caused by riots, civil unrest, or vandalism during such events.

- Aircraft or Vehicle Damage:Damage caused by an aircraft or vehicle that does not belong to the insured.

- Smoke Damage:Damage caused by smoke, regardless of whether it originated from a fire.

- Vandalism or Malicious Mischief:Damage caused by vandalism or intentional acts of destruction.

- Sprinkler Leakage:Damage caused by water leakage from automatic sprinkler systems.

Exclusions

Exclusions are events or circumstances that are specifically not covered by the insurance policy. These exclusions are designed to limit the insurer’s liability and prevent coverage for events that are considered too risky or unpredictable.

- Earthquakes:Earthquakes are typically excluded from fire and extended coverage policies. However, some insurers may offer earthquake coverage as an optional add-on.

- Flooding:Flooding is generally not covered by standard fire and extended coverage policies. Flood insurance is available through the National Flood Insurance Program (NFIP).

- War or Nuclear Events:Damage caused by war, nuclear attack, or radioactive contamination is typically excluded.

- Neglect or Intentional Acts:Damage caused by the insured’s negligence or intentional acts is not covered. For example, if a homeowner intentionally sets fire to their own property, they will not be compensated for the damage.

- Wear and Tear:Damage caused by normal wear and tear is not covered. For example, a roof that deteriorates due to age is not covered.

- Pest Infestation:Damage caused by insects, rodents, or other pests is typically excluded. However, some policies may cover damage caused by certain types of pests if they are determined to be a direct result of a covered peril, such as a fire or windstorm.

- Acts of God:While some acts of God, like windstorms and hail, are covered, others, such as earthquakes and flooding, are often excluded.

Examples of Extended Coverage

Extended coverage refers to additional perils that are covered beyond the basic fire coverage. These perils typically expand the scope of protection to include events that may not be directly related to fire. Here are some examples of situations where extended coverage would apply:

- Windstorm Damage:If a strong windstorm damages the roof of a house, extended coverage would typically cover the repairs.

- Hail Damage:If a hailstorm damages a homeowner’s car, extended coverage would typically cover the repairs.

- Vandalism:If vandals break into a home and damage the property, extended coverage would typically cover the repairs.

- Sprinkler Leakage:If a sprinkler system malfunctions and causes water damage, extended coverage would typically cover the repairs.

Limitations of Coverage

It’s important to understand that even for covered perils, there are limitations to the coverage provided by fire and extended coverage insurance. These limitations can include:

- Deductible:The deductible is the amount of money that the policyholder must pay out of pocket before the insurance company will start paying for claims. The deductible is typically a fixed amount, such as $500 or $1,000.

- Coverage Limits:The policy may have limits on the amount of money that will be paid for certain types of damage. For example, there may be a limit on the amount of money that will be paid for personal property damage.

- Exclusions:As mentioned earlier, there are certain events or circumstances that are specifically excluded from coverage.

- Waiting Periods:Some policies may have waiting periods for certain types of coverage, such as flood insurance. This means that the coverage will not be effective until a certain amount of time has passed after the policy is purchased.

Policy Structure and Key Provisions

A fire and extended coverage insurance policy is a complex legal document that Artikels the terms of the agreement between the insured and the insurer. Understanding the key provisions of the policy is crucial for both parties to ensure clarity and avoid disputes.

Policy Structure

A typical fire and extended coverage insurance policy is structured in a clear and logical manner, typically divided into sections that address specific aspects of the agreement. Here is a common breakdown:

- Declarations:This section includes basic information about the policy, such as the insured’s name, address, policy number, coverage period, and premium amount.

- Insuring Agreement:This section Artikels the insurer’s promise to pay for covered losses, defining the scope of coverage and the types of perils insured against.

- Exclusions:This section specifies perils, property, or circumstances that are not covered by the policy. These exclusions are important to understand as they limit the scope of coverage.

- Conditions:This section details the responsibilities of both the insured and the insurer, outlining the procedures for filing claims, providing proof of loss, and settling claims. It also includes provisions regarding policy cancellation and renewal.

- Definitions:This section clarifies the meaning of key terms used in the policy, ensuring a consistent understanding of the language used.

Roles of the Insured and the Insurer

The fire and extended coverage insurance policy establishes a clear relationship between the insured and the insurer, defining their respective roles and responsibilities.

- The Insured:The insured is the individual or entity who purchases the insurance policy and agrees to the terms and conditions Artikeld in the document. They are responsible for paying the premiums, complying with the policy conditions, and providing accurate information to the insurer.

- The Insurer:The insurer is the company that provides the insurance coverage. They are obligated to pay for covered losses according to the terms of the policy. They also have a responsibility to investigate claims, assess damages, and settle claims fairly and promptly.

Claim Filing Process

When a covered loss occurs, the insured is responsible for promptly notifying the insurer and following the procedures Artikeld in the policy. The claim filing process typically involves the following steps:

- Notification:The insured must notify the insurer of the loss within a specified timeframe, usually within a few days of the incident.

- Investigation:The insurer will investigate the claim to verify the validity of the loss and gather information about the extent of the damage.

- Proof of Loss:The insured must provide documentation to support the claim, such as police reports, repair estimates, and receipts for damaged property.

- Claim Settlement:Once the investigation is complete, the insurer will determine the amount of the claim and make a payment to the insured. The settlement amount may be based on the actual cash value (ACV) or the replacement cost value (RCV) of the damaged property.

Factors Influencing Claim Settlement, Fire and extended coverage insurance

Several factors can influence the settlement of a fire and extended coverage insurance claim, including:

- Policy Coverage:The specific perils covered by the policy will determine whether the loss is eligible for compensation.

- Deductible:The insured is typically responsible for paying a deductible, which is a fixed amount that is subtracted from the claim payment.

- Policy Limits:The policy limits the maximum amount the insurer will pay for a covered loss.

- Proof of Loss:The insured must provide sufficient documentation to support the claim.

- Co-insurance:Some policies require the insured to maintain a certain percentage of insurance coverage relative to the value of the property. Failure to meet this requirement may result in a reduced claim payment.

Policy Endorsements and Riders

Policy endorsements and riders are additions to the original policy that modify or expand the coverage. They can be used to:

- Increase Coverage:Endorsements can add coverage for specific perils or types of property not included in the original policy.

- Exclude Coverage:Endorsements can also be used to exclude specific perils or types of property from coverage.

- Modify Coverage:Endorsements can adjust the terms of the policy, such as changing the deductible or policy limits.

Factors Influencing Premiums

Fire and extended coverage insurance premiums are calculated based on a variety of factors that assess the risk of a property experiencing a fire or other covered peril. Understanding these factors can help property owners make informed decisions about their insurance coverage and potentially reduce their premiums.

Property Location

The location of a property significantly influences its fire insurance premium. Factors considered include:

- Fire Department Response Time:Properties located in areas with a shorter response time from the fire department generally have lower premiums, as the risk of extensive damage is reduced.

- Fire Hydrant Availability:Properties with readily accessible fire hydrants are considered less risky, as firefighters have a reliable water source for extinguishing fires. This typically translates to lower premiums.

- Proximity to Other Structures:Properties situated close to other buildings may face a higher risk of fire spreading. This can lead to higher premiums, especially in densely populated areas.

- Natural Disaster Risk:Properties located in areas prone to natural disasters, such as earthquakes or hurricanes, may have higher premiums to account for the increased risk of fire damage.

Property Construction

The type of construction used in a property plays a significant role in determining its fire insurance premium.

- Fire-Resistant Materials:Buildings constructed with fire-resistant materials, such as brick, concrete, or steel, are less susceptible to fire damage. This results in lower premiums compared to properties built with combustible materials like wood.

- Roof Type:A fire-resistant roof, such as a metal or tile roof, can reduce the risk of fire spreading. Properties with such roofs often have lower premiums.

- Sprinkler System:The presence of an automatic sprinkler system significantly reduces the risk of fire damage and can lead to lower premiums.

Property Usage

The intended use of a property is another crucial factor in determining its fire insurance premium.

- Occupancy Type:Properties used for high-risk activities, such as manufacturing or storage of flammable materials, generally face higher premiums due to the increased risk of fire.

- Number of Occupants:Properties with a higher number of occupants, such as apartment buildings, may have higher premiums due to the potential for increased human activity and the possibility of accidents.

Claims History

A property’s past claims history is a significant factor in determining its fire insurance premium.

- Frequency of Claims:Properties with a history of frequent claims, regardless of the cause, are considered higher risk. Insurance providers may increase premiums to reflect this increased risk.

- Severity of Claims:Properties with a history of large or severe claims may face higher premiums, as they are considered more likely to experience future losses.

Risk Mitigation Measures

Property owners can implement various risk mitigation measures to reduce their fire insurance premiums.

- Smoke Detectors:Installing and maintaining smoke detectors in accordance with local regulations can reduce the risk of fire damage and often lead to lower premiums.

- Fire Extinguishers:Having readily accessible fire extinguishers can help control small fires and prevent them from escalating. This can result in lower premiums.

- Regular Inspections:Conducting regular inspections of electrical wiring, heating systems, and other potential fire hazards can help identify and address potential problems before they become serious. This proactive approach can lead to lower premiums.

Premium Rates Across Providers

Fire and extended coverage insurance premiums can vary significantly across different insurance providers.

- Company Financial Stability:Insurance providers with a strong financial track record and a history of paying claims promptly are generally considered more reliable.

- Coverage Options:The specific coverage options offered by different providers can impact premiums.

- Discounts:Some providers offer discounts for safety measures, such as smoke detectors or fire extinguishers, or for bundling insurance policies.

Importance of Adequate Coverage: Fire And Extended Coverage Insurance

The importance of adequate fire and extended coverage insurance cannot be overstated. It serves as a crucial financial safety net in the event of a fire, protecting individuals and businesses from devastating financial losses. Underestimating the potential impact of a fire can have dire consequences, highlighting the need for a comprehensive and well-structured insurance policy.

Financial Consequences of Inadequate Coverage

Insufficient insurance coverage can lead to significant financial burdens in the aftermath of a fire. The financial impact can be severe, ranging from the cost of rebuilding or repairing damaged property to lost income and business disruption.

- Reconstruction Costs:Fire damage can be extensive, requiring substantial funds for rebuilding or repairing structures. Inadequate coverage may leave policyholders responsible for covering the difference between the actual cost of repairs and the insurance payout.

- Personal Property Loss:Fires can destroy personal belongings, including furniture, electronics, clothing, and valuables. If the insurance coverage is insufficient, policyholders may face significant financial losses in replacing these items.

- Lost Income:Businesses and individuals may experience lost income due to fire damage, particularly if operations are disrupted or a business is forced to close temporarily. Inadequate coverage may not provide sufficient funds to cover lost wages or business revenue.

- Living Expenses:After a fire, individuals may need to find temporary housing and cover additional living expenses. Inadequate coverage may not provide sufficient funds for these essential costs.

Real-World Examples of Fire Incidents and the Role of Insurance in Recovery

Real-world examples demonstrate the critical role of insurance in recovery after fire incidents. For instance, a recent fire in a residential building caused extensive damage, displacing several families. Those with adequate insurance coverage received timely compensation, enabling them to rebuild their lives.

In contrast, families with insufficient coverage faced significant financial challenges, struggling to cover reconstruction costs and living expenses.

Importance of Regular Policy Review and Potential Adjustments to Coverage

Regular policy review is essential to ensure adequate coverage. Over time, property values may increase, requiring adjustments to the insurance coverage. Life circumstances can also change, necessitating policy updates. For example, if a homeowner expands their home or acquires valuable assets, they should adjust their insurance policy to reflect these changes.

Role of Insurance in Protecting Assets and Financial Stability

Fire and extended coverage insurance plays a vital role in protecting assets and maintaining financial stability. By providing financial compensation for fire-related losses, insurance helps individuals and businesses recover from these devastating events. It provides a crucial safety net, minimizing the financial impact and allowing them to rebuild their lives and businesses.

Fire Safety Measures and Prevention

Fire safety is a crucial aspect of protecting lives and property. Implementing comprehensive fire safety measures in both residential and commercial settings is essential for minimizing the risk of fire incidents and mitigating potential damage.

Fire Safety Measures for Residential and Commercial Properties

A comprehensive fire safety plan should encompass various measures to prevent fires, ensure early detection, and facilitate safe evacuation.

- Regular Inspections and Maintenance:Conducting regular inspections of electrical wiring, appliances, heating systems, and chimneys can identify potential fire hazards early on. Regular maintenance, such as cleaning chimneys and checking smoke detectors, is essential for ensuring their proper functioning.

- Smoke Alarms and Carbon Monoxide Detectors:Installing smoke alarms and carbon monoxide detectors on every level of the building, including bedrooms, is crucial for early detection. These devices should be tested regularly to ensure they are operational.

- Fire Extinguishers:Fire extinguishers should be readily available in accessible locations throughout the property. Individuals should be trained on how to use them effectively in case of a fire.

- Escape Routes and Plans:Clearly marked escape routes should be established, and all occupants should be familiar with them. Regular fire drills can help ensure everyone knows how to evacuate safely in case of a fire.

- Fire-Resistant Materials:Utilizing fire-resistant materials in construction and furnishings can help slow the spread of fire and provide more time for evacuation.

- Proper Storage of Flammable Materials:Flammable liquids and materials should be stored in designated areas away from heat sources and in appropriate containers.

- Safe Use of Heating Devices:Space heaters should be placed at a safe distance from flammable materials and never left unattended.

- Electrical Safety:Overloaded circuits, frayed wires, and faulty appliances can be major fire hazards. Regular inspections and repairs can prevent electrical fires.

- Cooking Safety:Unattended cooking is a leading cause of residential fires. Always stay in the kitchen when cooking and never leave cooking unattended.

- Smoking Safety:Smoking should only be done in designated areas and never in bed or when drowsy. Cigarette butts should be extinguished properly in ashtrays.

Importance of Fire Prevention Strategies

Fire prevention strategies play a vital role in reducing the likelihood of fire incidents and minimizing potential damage.

- Reduced Risk of Fires:Implementing fire safety measures effectively reduces the risk of fire incidents occurring in the first place.

- Minimized Damage:Early detection and prompt response to fire incidents can significantly minimize the extent of damage caused by fire.

- Lower Insurance Premiums:Insurance companies often offer discounts to property owners who demonstrate a commitment to fire safety through measures like smoke detectors, fire extinguishers, and sprinkler systems.

- Enhanced Safety for Occupants:Fire prevention measures prioritize the safety of building occupants by providing early warning systems, safe evacuation routes, and fire-resistant materials.

Fire Safety Equipment and Their Role in Minimizing Damage

Fire safety equipment plays a critical role in minimizing damage caused by fire incidents.

- Smoke Alarms:Smoke alarms provide early warning of fire, allowing occupants to evacuate safely and firefighters to respond promptly.

- Sprinkler Systems:Sprinkler systems automatically release water in case of fire, suppressing flames and limiting damage.

- Fire Extinguishers:Fire extinguishers allow individuals to extinguish small fires before they escalate.

- Fire Blankets:Fire blankets can be used to smother small fires or to protect individuals from flames.

Fire Safety Tips for Different Types of Properties

| Property Type | Fire Safety Tips |

|---|---|

| Residential |

|

| Commercial |

|

| Industrial |

|

Question Bank

What is the difference between fire insurance and extended coverage insurance?

Fire insurance provides basic protection against losses caused by fire, while extended coverage policies expand this protection to include additional perils like windstorms, hail, and vandalism.

How are premiums for fire and extended coverage insurance calculated?

Premiums are influenced by factors such as property location, construction, usage, claims history, and risk mitigation measures. Insurance providers use a variety of methods to assess risk and determine premiums.

What are some common exclusions in fire and extended coverage insurance policies?

Exclusions vary by policy, but common examples include damage caused by war, nuclear events, and intentional acts of the insured.

How do I file a claim for fire damage?

Contact your insurance provider immediately after the fire incident. They will guide you through the claims process, which typically involves providing documentation and evidence of the damage.

Is it possible to increase my coverage limits for fire and extended coverage insurance?

Yes, you can typically adjust your coverage limits by contacting your insurance provider and requesting a policy change.