Dental Insurance Coverage: Can Veneers Be Covered By Insurance

Can veneers be covered by insurance – Dental insurance is a type of health insurance that helps cover the costs of dental care, such as cleanings, fillings, and extractions. It is often offered as part of a group plan through an employer, but it can also be purchased individually.

Dental insurance plans work similarly to other types of health insurance, with premiums, deductibles, and copayments.

General Coverage Structure of Dental Insurance Plans

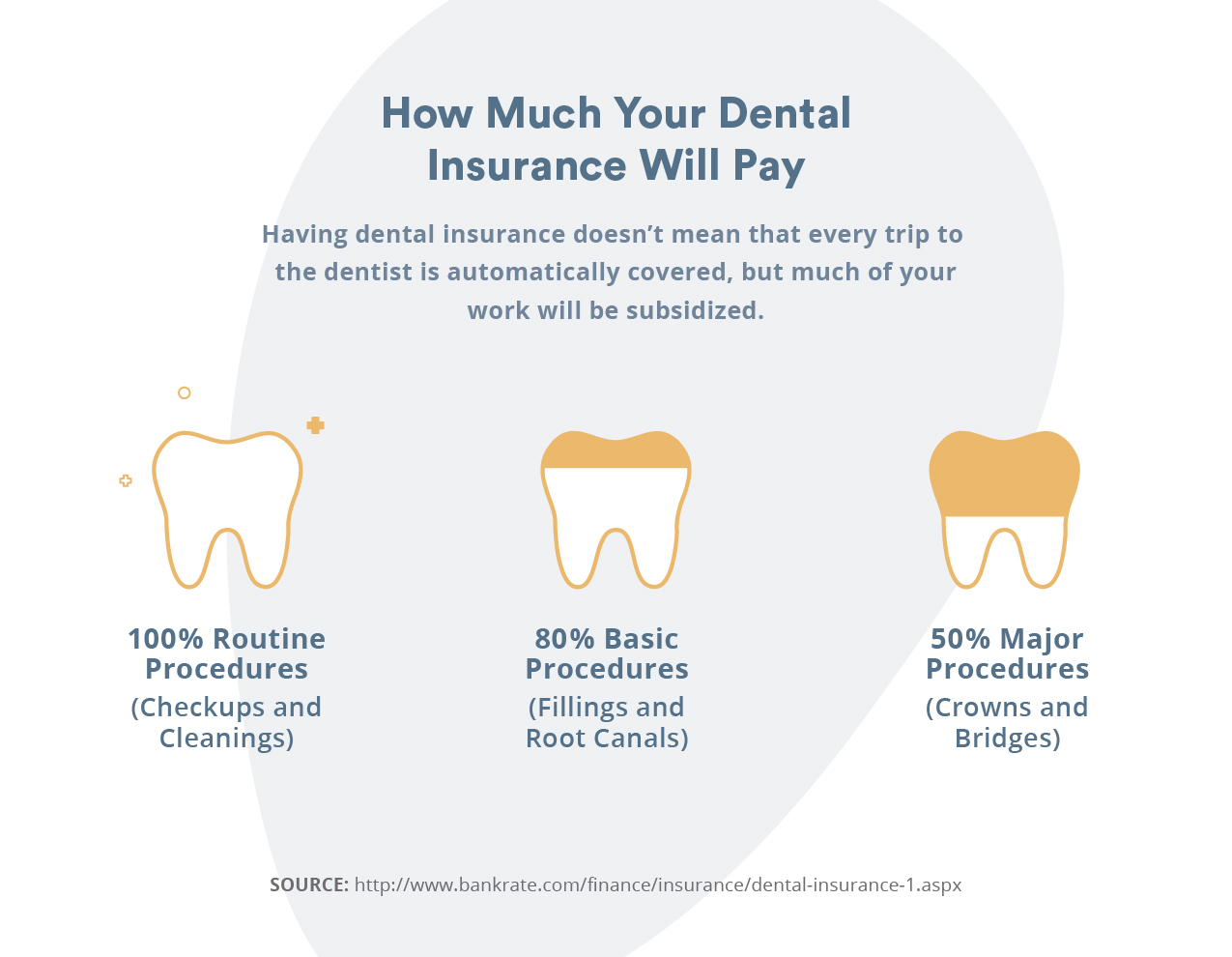

Dental insurance plans typically cover a range of dental services, but the specific coverage varies depending on the plan. Most plans cover preventative care, such as routine cleanings and checkups, at a higher percentage than other services. They often have a tiered structure, with different coverage levels for different types of dental services.

For instance, a plan might cover 80% of the cost of preventive care, 70% of the cost of basic restorative care, and 50% of the cost of major restorative care.

Common Exclusions in Dental Insurance Policies

Dental insurance policies often have exclusions, which are services that are not covered by the plan. Common exclusions include:

- Cosmetic dental procedures, such as teeth whitening or veneers.

- Dental implants.

- Orthodontic treatment for adults.

- Dental care for pre-existing conditions, such as gum disease.

Dental Procedures Typically Covered by Insurance

Most dental insurance plans cover the following procedures:

- Preventive care: This includes routine cleanings, checkups, fluoride treatments, and dental sealants. Preventive care is usually covered at a higher percentage than other services.

- Basic restorative care: This includes fillings, crowns, and root canals. Basic restorative care is typically covered at a lower percentage than preventive care.

- Major restorative care: This includes dentures, bridges, and implants. Major restorative care is often covered at the lowest percentage.

Impact of Insurance Premiums and Deductibles on Coverage

The cost of dental insurance is determined by the premium, which is a monthly payment that you make for coverage. The premium is often influenced by factors such as age, location, and the type of coverage. A higher premium typically means a higher level of coverage.

A deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. The higher the deductible, the lower the premium. A low deductible means you will pay less out-of-pocket for covered services, but you will have a higher premium.

Insurance Coverage for Veneers

Dental insurance often covers basic dental care, including cleanings, fillings, and extractions. However, veneers are considered cosmetic procedures, and insurance coverage for them is typically limited.

Reasons for Limited Coverage

Veneers are primarily aesthetic, improving the appearance of teeth rather than addressing functional issues. Insurance companies prioritize coverage for procedures that directly impact oral health and function.

- Cosmetic Enhancement: Veneers are primarily used to improve the appearance of teeth, such as addressing discoloration, chips, or gaps. Insurance policies typically focus on covering treatments that address dental health issues, not purely cosmetic enhancements.

- High Cost: Veneers are a relatively expensive dental procedure, and insurance companies often have budget constraints. Covering the cost of veneers for all patients could significantly impact insurance premiums.

- Lack of Medical Necessity: Insurance companies may not consider veneers medically necessary unless they are required to address a specific dental issue, such as severe tooth decay or trauma.

Factors Influencing Coverage Decisions

Insurance companies use various factors to determine whether they will cover veneers.

- Policy Terms: The specific terms of your dental insurance policy will dictate whether veneers are covered. Some policies may have specific exclusions for cosmetic procedures, while others may offer limited coverage for certain situations.

- Underlying Dental Condition: If veneers are necessary to address an underlying dental issue, such as severe tooth decay or trauma, insurance companies may be more likely to provide coverage.

- Prior Authorization: Many insurance plans require prior authorization for certain procedures, including veneers. This involves submitting a request for coverage before the procedure is performed, allowing the insurance company to assess the medical necessity of the treatment.

Partial Coverage Scenarios

While full coverage for veneers is rare, some insurance plans may offer partial coverage in specific circumstances.

- Dental Trauma: If veneers are required to repair damage caused by trauma, such as a broken tooth, insurance companies may provide partial coverage for the procedure.

- Severe Tooth Decay: If veneers are necessary to restore a tooth severely damaged by decay, insurance may cover a portion of the cost.

- Certain Medical Conditions: In cases where veneers are required to address a specific medical condition, such as a misaligned bite or a severe overbite, insurance companies may provide partial coverage.

Coverage Variations Across Providers

Different insurance providers have varying policies regarding veneer coverage.

- Plan Types: Some plans, such as dental HMOs, may have more limited coverage for veneers than PPO plans.

- Coverage Levels: Even within the same insurance company, different plan levels may offer varying levels of coverage for veneers. Higher-level plans may provide more comprehensive coverage for cosmetic procedures.

Alternative Options for Veneer Costs

Veneers can significantly enhance your smile, but the cost can be a barrier for some individuals. Fortunately, various options can help make this cosmetic dental procedure more accessible. Let’s explore some alternative ways to finance your veneer treatment.

Financing Options for Veneers

There are various financing options available to help manage the cost of veneers. These options can make this cosmetic dental procedure more attainable for individuals who might otherwise struggle to afford it.

| Financing Option | Description | Potential Benefits |

|---|---|---|

| Dental Payment Plans | Dental payment plans allow you to break down the cost of your treatment into manageable monthly installments. | These plans can help you avoid large upfront costs and spread out the payments over a longer period. |

| Dental Financing Companies | Companies like CareCredit and LendingClub specialize in financing dental procedures. They offer low-interest loans specifically designed for healthcare expenses. | These loans often have flexible repayment terms and can help you pay for your veneers without straining your budget. |

| Health Savings Accounts (HSAs) | HSAs are tax-advantaged savings accounts that can be used for eligible medical expenses, including dental procedures. | If you have an HSA, you can use the funds to pay for your veneers tax-free. |

| Dental Discount Plans | Dental discount plans provide access to discounted dental care, including veneers. These plans are typically less expensive than traditional dental insurance. | These plans can help you save money on your veneer treatment, even if you don’t have dental insurance. |

Dental Payment Plans

Dental payment plans are a common option offered by many dental practices. These plans allow patients to pay for their dental procedures in installments, often with a low or no-interest rate. Dental payment plans can offer several benefits, including:

- Affordability:By spreading out the cost over time, payment plans make it easier to manage the expense of veneers.

- Flexibility:Many plans offer flexible payment terms, allowing you to choose the amount and frequency of your payments.

- Convenience:You can often set up automatic payments to ensure your bills are paid on time.

Dental Discount Plans

Dental discount plans are membership programs that provide access to discounted dental care. These plans can help you save money on various dental procedures, including veneers. Dental discount plans are often a more affordable option than traditional dental insurance.

They typically have lower monthly premiums and no deductibles or waiting periods. However, it’s important to note that discount plans do not cover all dental expenses. They typically provide a percentage discount on the cost of procedures.

Health Savings Accounts (HSAs), Can veneers be covered by insurance

HSAs are tax-advantaged savings accounts that can be used for eligible medical expenses, including dental procedures. If you have an HSA, you can use the funds to pay for your veneers tax-free. This can be a significant benefit, as it can reduce your overall out-of-pocket costs.

To use your HSA for veneers, you’ll need to ensure that your dental procedure qualifies as a medical expense. You can consult with your dentist or HSA administrator to confirm eligibility.

FAQ Corner

What are the common reasons why insurance might not cover veneers?

Insurance companies often consider veneers as a cosmetic procedure, which may not be covered under standard plans. They may view them as elective treatments rather than medically necessary procedures.

Can I use my HSA to pay for veneers?

Yes, in some cases, you can use your Health Savings Account (HSA) to pay for veneers. However, it’s essential to check with your insurance provider and HSA administrator to confirm eligibility.

Are there any situations where insurance might partially cover veneers?

Some insurance plans may partially cover veneers if they are used to correct a functional issue, such as a chipped tooth affecting chewing. However, this is not always the case, and coverage will vary depending on your policy.

How can I negotiate payment options with my dentist?

Don’t hesitate to discuss payment plans or financing options with your dentist. They may offer flexible payment schedules or work with you to find a solution that fits your budget.